Bubble 3.0: The Insanity Bubble

Chapter 10, Section I

The bubble to end all bubbles

In my admittedly totally biased opinion, I believe this is one of the most important chapters of this book, if not THE most important. That’s because it pulls together an abundance of evidence on the sheer lunacy that commandeered America’s investing mindset in 2020 and 2021. If you were to suggest friends and family read just one chapter in this book, I’d recommend it for that purpose.

Harking back to Chapter 5 on Modern Monetary Theory (MMT), if America was truly practicing that controversial economic system in the early part of the 2020s, one would expect the nearly limitless liquidity MMT provides to show up in wildly speculative investor behavior. Was there any tangible evidence of that as 2021 was winding down? Maybe just a little…

Perhaps a reasonable way to start this chapter is to reflect on words uttered by former Fed chairman Alan Greenspan way back in late summer of 2002, when he was still venerated as “The Maestro” and the erstwhile tech bubble had blown itself to bits. To wit: “Bubbles are often precipitated by perceptions of real improvements in the productivity and underlying profitability of the corporate economy. But as history attests, investors then too often exaggerate the extent of the improvement in economic fundamentals. Human psychology being what it is, bubbles tend to feed on themselves, and booms in their later stages are often supported by implausible projections of potential demand. Stock prices and equity premiums are then driven to unsustainable levels. Certainly, a bubble cannot persist indefinitely.” (Emphasis mine)

Speaking of “certainly”, it certainly would have been more helpful to millions of investors if he had delivered these cautionary words three years earlier when the internet and dotcom mania of that era was still raging. Regardless, the wisdom of his utterances was well worth reflecting upon in the early years of the roaring 2020s because, in my opinion, the degree of speculation since Covid struck has, ironically, exceeded what was seen in the late 1990s. In Chapter 14, I will focus on the overall U.S. stock market, but for now let’s examine what is going on within some of the most casino-like realms of asset markets (using the word “asset” very loosely). These are where the quaint notions that Mr. Greenspan was referring to like “productivity”, “profitability” and “economic fundamentals” are total non-issues.

The below April 2021 cover from New York Magazine succinctly captures the prevailing zeitgeist of this era, the “new world of money”, as it refers to it, that I will chronicle below. It’s definitely a very brave new world... if not an utterly reckless one.

Figure 1

Cryptos

One of the most salient examples of the lack of economic factors is in the chaotic world of crypto currencies. Of course, there are no earnings, dividends, or profits (other than by trading them) that underlie the cryptos. This is not to disparage Bitcoin and Ethereum, which do have unique attributes in terms of growing acceptance by businesses and institutional investors alike. They also offer scarcity due to a limited amount of future supply. Further, there’s little doubt the blockchain technology that authenticates and facilitates transactions in them is here to stay.

However, the scarcity appeal of Bitcoin (which has a hard cap of 21 million units to be “mined” or created) doesn’t extend to the crypto space in general. As of early 2022, there are roughly 6000 different cryptos with more being created on a regular basis. Undoubtedly, there is a plethora of examples of the prevailing insanity in cryptos presently, but there is one in particular that, to me, perfectly captures the mood of the moment.

While there has been a lot of shameless promoting of various cryptos by their creators and paid floggers — often with the express intent of the insiders selling into the buying frenzy they whip up — that accusation cannot be leveled at Billy Markus, the co-founder of Dogecoin. In early 2021, Mr. Markus told The Wall Street Journal that: “The idea of Dogecoin being worth 8 cents is the same as GameStop being worth $325.” (We’ll get to that one later in this chapter.) “It doesn’t make sense. It’s super absurd. The coin design was absurd.” Perhaps what Mr. Markus was missing with his candid observations is that an exhaustive list of markets has become theaters of the absurd. But the theatrics of Dogecoin are definitely hard to top.

Though it was already up from half a penny per coin at the end of 2020 to the aforementioned 8 cents, amounting to a market value of $10 billion when he expressed his incredulity, it was ultimately heading to 64 cents for an $80 billion market cap (capitalization, i.e., the number of coins outstanding times market price) by May of 2021. This for something that, per its creator, was not just absurd, but super-absurd. As the Journal ironically noted, referring to Mr. Markus: “He set out to create a coin so ridiculous it could never be taken seriously.” Incredibly, there were blue chip companies with strong franchises, healthy dividends and growing profits that were trading for less than $80 billion during 2021. This was despite the fact that the U.S. stock market was trading at one of its priciest levels ever by multiple metrics. (Again, more on that topic in Chapter 14.)

One reason why Mr. Markus argued against his own brainchild’s worth was that he intentionally designed it to have unlimited supply, in contrast to Bitcoin, with its 21-million maximum. Why would rational investors pay as much as $80 billion for an alleged asset that could be produced in limitless quantities? (If you’re similarly wondering why people around the world value U.S. dollars so highly when the Fed is fabricating them in seemingly infinite amounts, you won’t get an argument from me.)

Despite its inherent worthlessness, Dogecoin’s extraordinary market success has brought about the sincerest form of flattery. By 2021’s third quarter, there were nearly 100 cryptocurrency tokens that included “doge” in their name.[i]

Beyond dodgy Dogecoin and the thousands of likely value-free cryptos floating around, there is also the issue of the so-called “stable” coins. (In my mind, due to their questionable long-term viability and fiction of stability a better name might be “fable” coins.) Tether is the dominant stable coin and is used for most crypto transactions, including Bitcoin. Thanks to my great friend and fellow newsletter author extraordinaire, Grant Williams, I came to believe in the summer of 2021 that Tether is a fraud. That’s a strong word, and it deserves some serious backing up… which is exactly what I’ll now do.

In case you don’t know, a stable coin is supposed to be backed one-to-one with something like U.S. treasuries or other ultra-safe assets. For years, Tether insisted that was true in its case. Unfortunately for the planet’s leading stable coin, New York State Attorney General, Letitia James, begged to differ.

Moreover, it’s my strong suspicion that either the U.S. Department of Justice, or the SEC (or both) are on the verge of untethering it once and for all. In fact, not long after I ran some of my Tether text in our July 23rd, 2021, EVA, Bloomberg announced that criminal indictments against its senior management were being prepared. (However, as I write these words, no actual indictment has occurred.)

Despite Tether’s protestations of its innocence, the New York Attorney General’s office secured an $18-million-dollar fine against it as well as its incestuously related firm, Bitfinex. Further, it banned both from conducting business in the state of New York. Sadly, that leaves the other 49 states, and millions of gullible crypto investors in them, at the mercy of this demonic duo, not to mention the rest of the world.

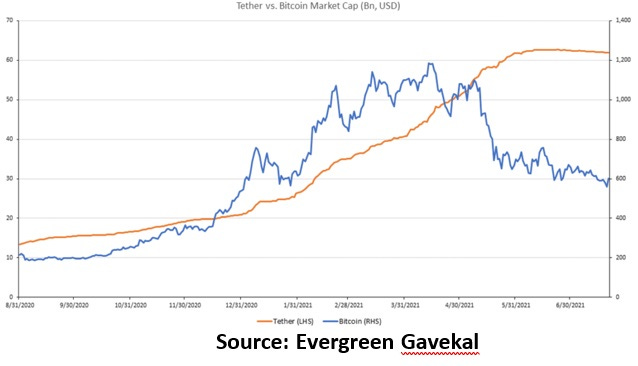

As you can see in the following chart, there was a remarkable correlation between the rise in the number of Tethers outstanding and the 900% moonshot by Bitcoin from the summer of 2020 until the spring of 2021. This pushed the world’s leading crypto to a mind-bending $1 trillion. Further, once the quantity of Tethers flatlined, Bitcoin entered a nasty correction, before another frenzied rally ensued, followed by a 40% faceplant from November 2021 to early January 2022 (as of late January, its decline was approaching 50%).

Figure 2

Even a casual observer might wonder if there wasn’t a causal relationship. In my mind, Tether going from around $12 billion worth of coins outstanding (remember, these are supposed to be backed one-to-one by real assets) to $64 billion is closely linked to Bitcoin ripping by 450% at the same time.

Skeptics about this linkage would point out that even Bitcoin’s starting value last fall of roughly $150 billion would be tough to move — certainly, all the way to $1 trillion — with just $60 billion of Tether (not all of which went into Bitcoin, by the way). However, this ignores two things: first, only about 20% of Bitcoin is estimated, on the high side, to actually trade; second, prices are set by the marginal transaction which is, even for U.S. large cap stocks, usually just a tiny fraction of the total market value.

Thus, $60 billion of fresh “capital” coming in can have a huge impact, particularly if there is a lot of leverage involved which, in the case of Tether and Bitcoin, is a given. (For a summary of an eye-opening, jaw-dropping and head-shaking podcast Grant did with two forensic investigators on the Tether situation in the summer of 2021, see the Chapter 10 Appendix)

Many crypto fans concede that Tether smells bad. But their common rationalization is that it really doesn’t matter to Bitcoin and the other digital “currencies”. Some even think Bitcoin would go up as money flows from Tether into Bitcoin directly, should the leading fable-, sorry, stable-coin implode.

They might be right but, again, I don’t think that’s what the odds favor. Because so much funding of cryptos has been via Tether and other “stable coins”, anything causing millions of investors to question their backing would seem to me to be a cataclysmic event in crypto space.

The crypto exchanges like Coinbase also would almost certainly come under intense pressure due to any broad crisis of confidence. Even some ardent crypto fans are advising investors to extract coins from the crypto exchanges to avoid what could essentially be a run on them.

If I’m right about this, there could be an exceptional buying opportunity in Bitcoin and possibly Ethereum as they should ultimately benefit from the collapse of the plethora of shitcoins. (Sorry for the vulgarity but it’s just so appropriate!)

Here’s one fascinating factoid to end this section on: during the Covid crisis, the market value of all cryptos was $154 billion. By March of 2021, it was $1.75 trillion. Astounding, yes, but not the ultimate shocker — four months later that number was $3 trillion. And yet our precious central bank is still afraid to utter the “B” word!

[i] Dogecoin was originally intended to be a satire of the cryptocurrency world. Apparently, it was designed in mere hours and its name is a play on a 2013 “meme” that went viral about a mythical spelling-challenged Shiba Inu — hence the “Doge” instead of “Dog”. Obviously, that pedigree makes it worth the $30 billion it was still valued at in late 2021. Obviously!

Section II To Be Released February 2nd

[i] Dogecoin was originally intended to be a satire of the cryptocurrency world. Apparently, it was designed in mere hours and its name is a play on a 2013 “meme” that went viral about a mythical spelling-challenged Shiba Inu — hence the “Doge” instead of “Dog”. Obviously, that pedigree makes it worth the $30 billion it was still valued at in late 2021. Obviously!

David, to confirm you are not releasing these chapters in numerical order?