Bubble 1:0 – In the beginning…

As the “Roaring ‘90s” reached their intoxicating end, and the calendar, as well as computers, flipped over into a new century and millennium, tech stocks displayed no evidence of suffering an early-year hangover. Y2K turned out to be a non-event and the Nasdaq kept rocketing. By early March of 2000, the “NAZ” was up another 24% (or at about a 208% annualized rate), bringing its surge from the lows of the 1998 Asian crisis trough to a mind-blowing 257%. Incredibly, this monster move occurred in less than a year-and-a-half. Then, virtually overnight, the tech world shifted on its axis.

There are typically multiple pin thrusts that puncture a bubble as immense as the one created by the tech/internet mania. This explosive deflation was no exception. The first prick was, in hindsight, the failure of several new issues by dot.com entities. Even as early as April 2000, the 149 IPOs which had already occurred that year were down an average of 45% from their first-day close (though this was typically up, sometimes considerably, from the IPO price). Suddenly, the IPO market was no longer a gullible supplier of limitless funding, not to mention a fabulously lucrative exit strategy for early investors.

The shockwaves reverberated quickly through the start-up ecosystem. With the IPO market on its heels, venture capital-types became increasingly choosy about which business plans they would finance. The torrent of money that had been sloshing through Silicon Valley and Seattle stopped almost as if someone had closed the gates of a giant sluice. As always occurs when a boom goes bust, the losses came fast and furiously. By the summer of 2000, the Nasdaq was down an ulcer-inducing 35%.

Another factor behind the plunge, ironically, was good news about Y2K. The uneventful transition removed the Fed’s rationale for not hiking rates further. In January of 2000, the Fed hiked its overnight rate to 5.75%. (Yes, those were the days when holding cash wasn’t penalized; in fact, it was earning a net-of-inflation rate of 2%). The stock market, particularly tech stocks with nonsensical valuations and, usually, a complete absence of yield, had some serious competition for investors’ dollars.

This would prove to be the first of 7 tightening moves the Fed initiated from mid-1999 through mid-2000. Despite the accelerating tech meltdown, the Fed hiked again in June 2000, pushing the Fed funds rate up to nearly 6 1/2%. With inflation running at 3 ½% that year, the real return on money market-type accounts rose to roughly 3%. Two decades ago, cash was definitely not trash and this obviously posed a competitive threat to the stock market, especially once the thrilling gains had turned into chilling losses.

As 2000 came to a close, and what would turn out to be the world-shaking year of 2001 began, hopes in “tech land” were high that the worst was over. This seemed a reasonable conclusion, given that the NASDAQ finished the year down a stunning 61.2%! Yet, unfortunately, for all those true believers in the glorious future for the internet and high technology, of which there were legions, the carnage in tech intensified.

Even prior to the horrific events on September 11th, 2001, the Nasdaq fell another 31.2%, leaving it down 66% from its March 2000 apex before a feeble rally occurred that summer. The inconceivable nightmare of the 9/11 terrorist attacks, which would reverberate around the planet for years to come (and still does), only intensified the tech devastation. From the peak of the summer bounce to the post-9/11 low, the Nasdaq melted by another 35%, before a vigorous year-end recovery erased most of the losses caused by the 9/11 panic. Regardless, for all of 2001 the Nasdaq had swooned an additional 20.8%, on top of the 61.2% shellacking in 2000.[i] Many assumed the worst was over. They were, once again, wrong. Even to my formerly tech-skeptical eye, it seemed as though further significant downside was unlikely.

Yet, notwithstanding some rousing rallies during the two-and-a-half-year bear market in almost all things tech, once the “NAZ” finally hit bottom in the fourth quarter of 2002, it had fallen from 5000 to 1100, a monstrous value annihilation of 78%. Not since the Great Depression, when thousands of banks failed and America looked to be on the brink of sheer economic collapse and/or a social revolution, had a major index declined by this magnitude.

The Fed’s earlier unwillingness to put out the raging speculative fire by raising margin requirements had come back to haunt it, and the world, as nearly all global stock markets were ferociously mauled. Alan Greenspan’s “Maestro” reputation was in serious jeopardy and his failure to follow through on his 1996 “irrational exuberance” message was widely criticized. The Greenspan-led Fed then proceeded to make a difficult situation much, much worse.

Another bubble to cure the crash

With almost hysterical pressure from high-profile sources, especially the New York Times’ Paul Krugman – who, in 2008, ironically, would win a Nobel Prize in Economic Sciences – the Fed kept cutting its overnight rate until it got down to the then unheard-of level of 1% by June 2003. Despite the U.S. economy having only endured a mild recession in 2001 — most remarkable given the twin shocks of the tech bust and September 11th — Mr. Krugman literally begged the Fed to create another bubble. Intentionally or not, Mr. Greenspan and his esteemed colleagues at the Federal Reserve Board, which included future Fed chairman Ben Bernanke, did exactly that.

Even as the U.S. bounced back from its technical recession (GDP actually rose 1% in 2001 and 1.8% in 2002, despite the tech crash and the terrorist attacks), the Fed left its overnight rate at 1% through May of 2004. This negligible cost of short-term money turned up the gas to high on an already simmering housing market. With adjustable-rate mortgages (ARMs) becoming all the rage, in order to fully exploit the collapse in short-term interest rates, the stage was set for lift-off into the “bubblesphere”.

Yet, even as mortgage debt more than doubled from 2000 to 2007 and housing prices rose by 80%, the Fed was oblivious to the rapidly rising dangers. Perhaps it drew comfort from the plunge by sub-prime mortgage defaults in those years but that was soon to prove to be the ultimate red herring — with massive amounts of red ink hitting the banking system as these spiked to nearly 14% by 2008.

Source: Bloomberg, Evergreen Gavekal

It was during the boom years of 2003 through 2006 that both the mortgage industry and Wall Street formed the unholy alliance that would become immortalized in Michael Lewis’ blockbuster, The Big Short. Mortgage originators were lavishly incentivized through their cornucopia of fees to extend credit to nearly anyone who could fog a mirror. Unlike in bygone days when traditional banks and S&Ls would create loans and often hold them on their balance sheet, thereby ensuring a fair degree of prudence, the new breed of “originate and securitize” mortgage players had no residual skin in the game. By securitizing (i.e., bundling many mortgages into a package and selling them to Wall Street), the originator off-loaded the credit risk. Ergo, a tremendous moral hazard was created at ground zero, where the loan was initiated.

The next moral hazard was Wall Street (what a shock!). Its clients, both institutional and retail, were clamoring for yield. As usual, The Street was thrilled to comply… and supply. After all, it had only been a couple of years earlier when savers and investors were earning 6 ½% on cash while longer-term investment grade corporate bonds and preferred stocks were yielding 8% to 9%.

In what was to be a sneak preview of the conditions that would last for the following decade – the era of Bubble 3.0, per this book’s title – Wall Street showed extraordinary ingenuity in creating vehicles to satisfy the ferocious appetite for yield. It began to manufacture CDOs by the droves, those securities more formally known as Collateralized Debt Obligations. These would be at the epicenter of the coming 9.0 planetary financial earthquake. Increasingly, these CDOs were populated by the subsequently notorious sub-prime mortgages. Why? Because of their lofty yields and, incredibly, as we will see in a moment, their perceived low risk.

To that point, and next up on the moral hazard list, were the rating agencies. Entities such as Moody’s and Standard & Poor’s, the Big Two (Fitch being a distant third), were compensated not by the buyers of the securities they rated but by the issuers, meaning the Wall Street underwriting machine. As Warren Buffett’s long-time partner, Charlie Munger, is famous for having declared, “Show me the incentive and I’ll show you the outcome.” In this case, the outcome was a steady stream of AAA-ratings on mortgage securitizations comprised totally of sub-prime loans. The logic, such as it was, for this seemingly absurd alchemy of turning junk into gilt-edged securities had to do with the supposed magic of “tranching”. (Please see the Appendix for an explanation of this remarkable process.) But that wasn’t to be the big surprise of this egregious example of mass greed.

One could make the argument that the rating agencies’ failure to do their job was the most indefensible. After all, the mortgage industry is in the business of making and selling as many loans as the markets and the regulators (more on them shortly) would allow. The same is true with Wall Street. But the rating agencies are supposed to be the adults in the room, warning professional and amateur investors if securities are high risk, or are vulnerable to adverse conditions.

Certainly, in the past, the assumption was that if a security was rated AAA, as so many of the sub-prime CDOs were, then it could withstand even a serious recession. In fact, it was common for a very high- grade debt instrument to rise in value during tough times, the well-known flight-to-quality phenomenon. But, regardless, the belief was that they should at least hold their own during bust conditions, as they had during the 1930s. The crisis of 2008 shattered that precedent.

The operating assumption in bestowing a AAA-rating on sub-prime CDOs was that the home default experience would be similar to past down-cycles. Few, other than the cranky renegades such as the stars of The Big Short, were connecting the dots between incredibly lax mortgage underwriting, home prices that were the furthest above their trend-line in history, and, as a result, affordability that was off-the-charts awful, as you can see in Figure 2 below.

In his after-the-crisis apologia, Alan Greenspan would concede that it shocked him how financial institutions could have been so imprudent--despite the fact that history is loaded with examples of exactly such reckless behavior on the part of banks and insurance companies. He had also assumed that securitization was a good thing, as the leveraged banking and lending system was off-loading its credit risks to entities like mutual funds who typically were cash buyers. What he somehow missed was that the banks’ investment departments were as furiously accumulating these “securities” as their mortgage divisions were disposing of them.

Meanwhile, regulators like the SEC, the FDIC, and the Comptroller of the Currency, were in a deep-REM slumber. Nothing was done to slow down, much less stop, the craziness. It wasn’t like they couldn’t see what was happening with home values and mortgage debt. The numbers were hiding right there in plain sight, per Figure 2 above.

The New York Fed, given its proximity to Wall Street, should have been in its grill, pushing back vigorously on the blatant shenanigans. Instead, its president (and future Treasury Secretary) Timothy Geithner gave a speech in 2006, close to the top of mania, in which he said: “You are meeting at a time of significant confidence in the strength of the global economy and in the overall health of the financial system… the core of the U.S. financial system is stronger than it has been in some time. Capital levels are higher and earnings stronger and more diversified… We have seen substantial improvements in risk management practice and in internal controls over the past decade.”

The fact that Mr. Geithner could be appointed Treasury Secretary after the crisis that he had no clue was brewing, and which had morphed into the worst financial panic since the 1930s, is certainly a testament to the inherent job security in working for the government. But it is stunning, and more than a bit terrifying as an American, to think that just two years later, everything he had spoken turned out to be complete nonsense. (In a later chapter, we will examine similar language voiced by senior Fed officials in recent years.)

Sadly, nearly all Wall Street strategists and money managers were oblivious or in total denial. (The smug portfolio manager portrayed in The Big Short, who completely blew-off the concerns of the housing bears, has an uncanny resemblance to Legg Mason’s former star Bill Miller.) However, there were a few brave and insightful exceptions. My good friend Danielle DiMartino Booth, who is cheering me on as I write this book, was one of them. Danielle is the author of the critically acclaimed book Fed Up and was a senior advisor to then Dallas Fed President, Richard Fisher. As such, she had a courtside seat to the inner workings of our country’s central bank during the lead up to the crash.

In her words, “In late 2006, after having written extensively on the potential for the housing bubble to unleash systemic risk across the global financial system, I arrived at the Fed just as home prices were beginning to crack. I was blown away by the calm and the blind acceptance of Alan Greenspan’s misguided creed that the economic benefits of homeownership, regardless of buyer qualification, outweighed the financial stability consequences precious few within the Fed saw coming.”

David Rosenberg, then chief North American economist at Merrill Lynch, and Pimco’s Paul McCulley were other lonely voices of caution. This author had the privilege of hearing them speak at John Mauldin’s Strategic Investment Conference in the years leading up to the housing crash. They provided me with critical data and other hard facts which influenced my decision to prepare my clients’ portfolios for a housing-driven bust.

The aforementioned lowest-rated slices (tranches) of sub-prime CDOs became the first, and worst, casualties of the housing bust. Most were wiped out during the early phase of the housing melt-down. But what was really shocking — and began to threaten the global banking system — was the utter collapse of the AAA-rated tranches.

By late 2008, a number of these were trading at around 30 cents on the dollar, meaning holders who typically had purchased them at or around par were sitting on losses of 70%. Since many of the owners of these instruments were banks with thin amounts of equity capital (especially in the pre-crisis days), losses like those were life-threatening. Moreover, because these were AAA-rated mortgage-backed securities (MBS) vs traditional home loans, banks were only required to have 1.6% in reserves set aside vs. 4% for traditional “whole” mortgage loans. Obviously, the 1.6% reserve was just a tad on the light side.

Source: Bloomberg, Evergreen Gavekal (as of June 7, 2018)

Greatly compounding this debacle was a formerly obscure accounting rule that had been enacted in 1993: Financial Accounting Standard 115. It required financial institutions to use “fair value accounting”, more popularly (or, by 2008, very unpopularly) known as “mark-to-market” accounting. In other words, banks and insurance companies were required to value their held assets at fair market value. From 1993 through 2007, this new rule didn’t pose any serious problems (the banking industry was not a significant holder of tech stocks). But once the bottom fell out of the housing market in 2008, it quickly became catastrophic.

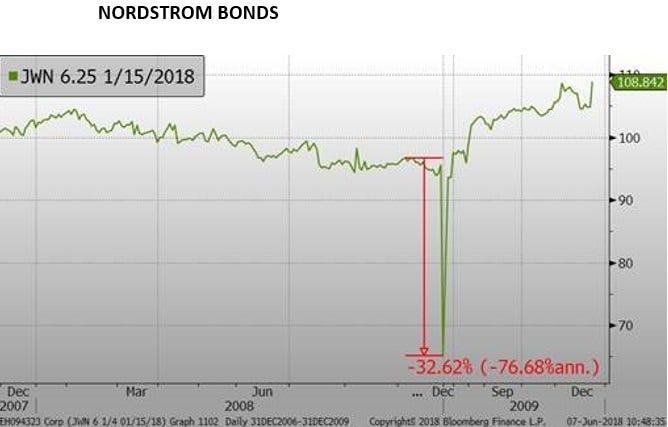

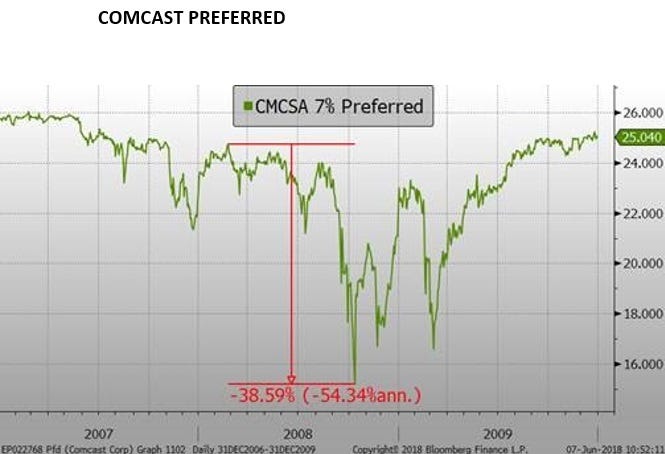

It soon became clear that the financial system was loaded with sub-prime CDOs and other derivative securities whose values had collapsed. Even traditional investment-grade bonds and preferred stocks, from companies such as Nordstrom and Comcast, plunged 30% to 40% as the planet was essentially engulfed in a global margin call.

Source: Bloomberg

Source: Evergreen Gavekal

With the new mark-to-market rule requiring financial institutions to value these formerly low-risk assets at fire-sales prices, it became apparent that nearly all U.S. banks and insurance companies were imperiled. Short sellers were circling even America’s strongest financial entities. The more the panic intensified, the lower stocks and bonds went. It was a classic doom loop.

This catastrophic chain reaction among financial institutions is why busts that involve the banking system are so horrific. Of course, you can’t have a terrible bust without an immense bubble, for which the housing/mortgage unquestionably qualified. This thunderous implosion literally imperiled the entire planet’s financial ecosystem.

Opportunity (mostly) lost

In America, Lehman failed, as did Fannie Mae and Freddie Mac (both government-sponsored entities, or GSEs), along with the nation’s largest savings institution, Washington Mutual. Massive insurer AIG was saved only due to a government rescue that effectively wiped-out shareholders. It truly looked like no big bank or insurance company was safe.

During this blood curdling time, in the fall of 2008, my newsletter repeatedly urged the Fed and/or the U.S. treasury to borrow (note: not print) a huge sum — like $1 trillion — and then invest the proceeds in the open market in highly rated corporate bonds and mortgages. Because T-bill yields had plunged to almost nothing, this was virtually free money and the rates the government would be securing were in the high single digits, often above 10%.

As I argued at the time, the Fed would have made a killing, an opinion which future events proved out. It also would have almost certainly arrested the free-fall virtually overnight. (Please see the Appendix for an elaboration about this important topic.)

Instead, in 2008 and into 2009, crucial terror-wracked months went by as the government clumsily rolled out the TARP* (Troubled Asset Relief Program) which initially did very little to restore confidence. The Fed, for sure, introduced some effective calming moves like guaranteeing money market funds, which did lower the panic level. And it executed the trillion-dollar intervention I had pleaded for, but it resorted to the previously described QE. In other words, it created the funds from its computers – rather than borrowing in the bond market as it had always done in the past – initiating a series of these digital money fabrications that continue to this day. (De facto QE was bizarrely restarted in America in September of 2019, despite a sub-4% unemployment rate, even prior to Covid).

Further, instead of investing the trillion where it was most needed — into corporate debt-like securities with astounding yields and bombed-out prices — it invested that immense sum in the most overpriced debt securities on the planet: U.S. treasuries and government-guaranteed mortgages. Agonizingly, the Fed missed a chance to invest taxpayer money at credit spreads (the difference between the yield on government and corporate bonds) at the highest levels since the darkest days of the Great Depression.

Figure 6

Source: Bloomberg

Despite these splashy but clumsy efforts, it wasn’t until the mark-to-market provision was defanged in mid-March of 2009 that risk assets (like stocks) began their spectacular rise from the ashes. This included bonds such as Nordstrom’s issue shown above which, by July 2009, was back at face value, providing a 58.6% return to those who bought into the teeth of the panic. In fact, for several years after the turn, securities such as those matched or even exceeded the returns from stocks.

For investors with courage enough to buy the debt securities from AIG at 10 cents on the dollar, the return over the next four years was 754%. At the time, I was vehemently urging my readers to buy these types of corporate income securities. But, frankly, most were so paralyzed by fear that they missed this once-in-several-generations opportunity. (The AIG subordinated debt issue described above also paid a cash flow yield of roughly 80% to investors who bought it at a 90% discount to face value; remarkably, it never missed a payment, thanks to the tens of billions of government support which, by the way, was fully recouped.)

Even today, there are highly intelligent investment professionals who believe the government made a monstrous error by intervening. I do not count myself among them. Despite the ham-fisted way it was done, it worked, and I shudder to think what would have happened had they not resorted to measures that no one would have dreamed of mere months earlier. It was truly a near-death experience for the world’s financial system.

However, that does not exempt the Fed nor the government’s regulatory bodies from the primary responsibility for the disaster that still haunts us today. By allowing bubbles to expand to immense proportions without trying to cool down markets (such as by raising margin requirements, tightening lending standards, requiring more capital to be held by banks, preserving the separation of underwriting and banking, prohibiting rating agencies from being paid by the very companies they are supposed to scrutinize, to name a few), American policymakers blew it big time.

The multi-trillion-dollar questions are: 1) have they learned from their past disastrous misjudgments, and 2) should investors trust in their assurances that the financial system is now safe and sane? At the time I was creating this book through our newsletter’s monthly editions, I wrote that we would only know for certain during the next bear market and/or panic. Covid, of course, produced those conditions on an existential scale.

To its credit, the Fed resorted to even more extreme and creative rescue measures, particularly the intervention in the crashing corporate bond market, the move I had suggested during the Global Financial Crisis of 2008/2009. This was the vital lesson it had learned from the GFC that it deftly applied in March of 2020, as financial markets were in total pandemic panic mode. As I had postulated a dozen years ago, it only needed to acquire a small amount of high-grade and low-grade private sector debt to turn the market on a dime. Yet, as noted before, it was that announcement which killed the bear market and brought the latest romping bull market to life.

On the less clever side, America’s central bank now appears to be in a prison of its own design, as we will see in forthcoming chapters. Whether it can escape without severe damage to the U.S. economy and its credibility, will be perhaps the most important financial story of this decade.

[i] A brief explanation is in order of how compounding losses, especially of a sizable nature, impact a starting value. For example, if you start with $100,000 then lose 50% and another 50% after that, you aren’t down to zero. Rather you still have $25,000 left. That’s pretty much what happened to tech investors from 2000 to 2002.