While there’s still time…

Is it too late? Has Bubble 3.0 already popped? Frankly, writing those words seemed almost unimaginable a few months ago. But something drastic is underway as I craft this penultimate chapter of Bubble 3.0 in December of 2021.

In fact, what’s occurred in the U.S. stock market lately is unlike anything I’ve ever seen in my 43-year career. But the good news is, at least so far, it’s not too late to take steps to protect your wealth from the demise of this third bacchanal of mass speculation. As you hopefully realize by now, in my opinion, this version has been the most out-of-control of them all.

So, what was occurring as 2021 drew to a close that has the makings of a paradigm-ending event? One answer to that relates to the last chapter on the Fed, and it’s reappointed (but beleaguered) leader, Jay Powell. Basically, he has had a belated epiphany. In this case it’s an economic, not spiritual, awakening and it pertains to inflation. After insisting for nearly all of 2021 that its powerful resurgence was “transitory”, Mr. Powell has told the world to retire that word. In late November, he shocked markets by saying the Fed was likely to accelerate its recently announced “tapering” – i.e., reducing the $1.44 trillion of bonds it has been buying annually with its Magical Money Machine. This was despite the emergence of another serious Covid threat, the oddly named Omicron virus.[i]

Mr. Powell further wrong-footed market participants, ever-hopeful of never-ending Fed largesse, by focusing on the latest virus variant’s inflationary potential, rather than the harm it could cause the economy. The latter view would have been greatly preferred because it implies even more Fed easing. These days that largely entails additional money printing, the polar opposite of tapering.

Even prior to Mr. Powell’s long overdue wake-up call on inflation, the U.S. stock market was behaving in a peculiar fashion. Despite repeated new highs in the S&P and the Nasdaq through most of November 2021, the number of stocks making new lows versus new highs was shockingly lopsided… and the wrong way.

As of November 22nd, there were 554 new Nasdaq lows versus only 213 new 52-week highs. (Note that the Omicron news didn’t break, at least widely, until Thanksgiving Day, November 25th) Similarly, for four consecutive days up to that date, there were nearly double the declining issues compared to those rising.

While that could have been dismissed at the time as mere noise, though of a most unusual nature, the carnage continued into the week following Thanksgiving. This was despite the fact that there was a growing medical consensus the Xi – sorry, Omicron – virus produces mild symptoms in most cases. As time has gone by, that view has been largely affirmed.

By Wednesday, December 1st, when the S&P 500 was down a mere 4% from all-time highs, there were more than 486 broadly traded stocks, selling for at least $2, that had receded at least 25% over the previous month! (To be clear, this is out of nearly the entire universe of publicly traded stocks, not just the S&P 500 but note that this does refer to “broadly traded” issues). Along similar lines, only 4.5% of the 3000 largest U.S. stocks were trading above their 10-day moving average. While you might dismiss that as a too-short-to-be-meaningful timeframe, it nonetheless was equivalent to March of 2020 during the worst of the Covid-induced market meltdown.

Candidly, in my more than four decades in the financial business, I can’t recall ever seeing such a plethora of stocks that have lost a quarter of their value, or more, when the S&P 500 was still within spitting distance of an all-time high. In early December, there were 615 companies with at least a $1 billion market capitalization that were down 30% or more from the 52-weeks high. Moreover, this list contained many of America’s most exciting growth stocks that were once leaders of the post-Covid bull run.

The problem was that the bulk had previously become ridiculously inflated, per my aforementioned reference to them as COPS, the Crazy Over-Priced Stocks, in Chapter 14. In other words, the problem wasn’t with their business models (at least not yet), it was with their market valuations. A classic example of this was DocuSign, which crashed 40% on December 3rd alone, leaving it 55% lower than its peak three months earlier. Its great crime: to report revenue growth of “only” 30% versus the 40% anticipated by the market. Oh, the crushing burden of great expectations…

Illustrating how absurd conditions had become during 2021, nearly two-thirds of the Russell 3000 Growth Index were losing money! Despite that slight impediment, this index finished 2021 up 24%.

Figure 1

Similarly, if you’d been lured into the “meme” stock space — which attracted massive media coverage, mostly of an approving nature, when they were doing their SpaceX-type moves — it was also a bullet-train wreck. The standard bearers for that mania, which crested in the first half of 2021, were GameStop and AMC Entertainment. As of December 3rd, 2021, they were down 63% and roughly 50%, respectively, from their apexes, around when they tended to pull in the lion’s share of investor dollars. This included funding multi-billion-dollar stock offerings by both companies; i.e., there was real money invested at nutty prices.

The unpleasant reality for each of these twin playthings of the nouveau rich (in my mind, NFL, as in “Not For Long”) is that they could easily fall much further and still be overvalued. Both GameStop and AMC are emblematic of the Russell 3000 Growth Index noted above as they remain solidly unprofitable, despite their astronomical returns in 2021. (They finished that year up 830% and 1440%, respectively, despite their recent price plunges.)

Figure 2

The increasingly obvious breakdown in a litany of once market-leading issues accentuated a trend that had been in place for years: the constant stock price ascent of America’s mega-cap tech companies. This elite cohort is headed by Apple, Microsoft, and Google. In other words, money was fleeing the long list of cracking hyper-growth stocks and further crowding into those three which have market valuations of $2.94 trillion, $2.57 trillion, and $1.96 trillion, respectively, as of early December 2021. Accordingly, just those three companies had a combined market value of almost $7.5 trillion. By contrast, the entire German stock market was worth $2.6 trillion at that time.[ii]

The odds are that the AMG stocks mentioned above — along with other stalwart massive cap issues such as Amazon, Facebook (now, Meta), Nvidia, Netflix and a few others — are likely to come under pressure soon, perhaps by the time you read this section.

Is the Fed put kaput?

A major problem the market had as it looked to be in a stealth correction mode was that the Fed remained in nearly maximum stimulus stance. When the mighty S&P was staggering in late 2018, very nearly entering bear market territory of minus 20%, the Fed had been tightening for years — albeit, at its usual post-Paul Volcker sloth-like pace. This meant it had room to cut rates a decent amount, typically a market rallying action. It also had been shrinking its balance sheet that was loaded with bonds acquired via its series of Quantitative Easings (QEs).

However, as the calendar was ready to flip 2021 into the slipstream of time, that was not in the realm of the possible. With inflation roaring like it hadn’t since the early 1980s, further Fed easing had become counter-productive. (That it continued to fabricate money at over a $1-trillion-dollar annual rate throughout all of 2021, notwithstanding overwhelming evidence of extreme overstimulation, is likely to be the prime exhibit in the Fed’s Bubble 3.0 Hall of Shame.) As noted above, Mr. Powell rattled easy money-addicted Wall Street by having the temerity to suggest it might shut off the monetary sluices earlier than previously disclosed.

Consequently, it began to dawn on market participants that should prices continue to erode, there was, for the first time in decades, no “Fed Put” waiting in the wings.[iii] You could say the Fed’s vaunted put was kaput! (As you will read shortly, I’m not quite ready to give the Fed’s Put the Last Rites.)

As I write these words, I can’t be sure, of course, if a serious decline is beginning to unfold. However, that is my suspicion. At the very least, I expect it will produce a situation similar to early 2000 when the grotesquely overpriced growth stocks of that era began to vaporize, causing a massive movement of money into the value sectors that had been falling for the prior two years. It was the triumph of “old economy” over “new economy” stocks, and I expect a repeat in the first few years of this decade, if not even longer.[iv]

This is a decent segue into the main topic of this chapter: how to avoid being collateral damage when Bubble 3.0 implodes. Steering clear of stocks with astronomical P/E ratios is one critically important way of doing so; in fact, in my career, I’ve never seen such a multitude of companies — most of which I’ve never heard of — trading at 100 times their earnings… and, often, much higher. This is despite the recent pummeling so many of them have endured. There simply are not anywhere near that many stocks deserving of such heroic valuations. Most of them are going to be crash, burn, and explode, a process which appears to be presently underway.

As was the case in 2000, there are still numerous companies selling at single-digit to mid-teens P/Es. In many cases, these are of immensely higher quality than the de facto start-ups trading at $50 billion valuations, though the latter have been melting fast lately. Since Omicron became front page news, many high-grade issues have come down even further because, in many cases, they are economically sensitive. Of particular interest are energy securities, as I will discuss in more detail shortly, even though they have bounced back sharply since Omicron related lockdown fears have subsided.

Additionally, those entities which are heavily involved in the essential building-blocks of electric vehicles (EVs) and/or their batteries, have come down hard. Examples are copper and aluminum producers. (As of early March 2022, most of these have roared back, reducing some of the future upside.) This creates another way to avoid the madness of crowds and hide out in low-expectation securities, which have the potential to eventually become high-expectation securities. This transformation is when really big money is made such as happened with Microsoft since 2014 (more on MSFT’s extraordinary transition to follow). As with energy securities, the rebound in many of these issues since Xi — dang, there I go again, Omicron — went viral has been significant, reducing future return potential.

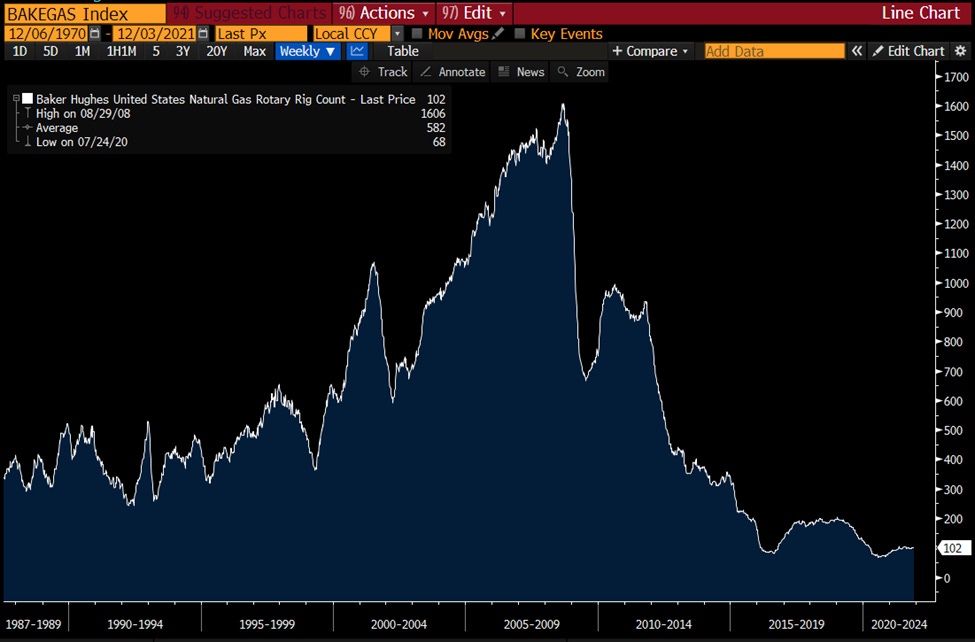

Basically, I believe the best protection investors can afford themselves at this time is by investing in scarce assets, particularly where there are supply constraints. For example, as discussed in Chapter 9 on the green energy bubble, high prices are failing to attract much in the way of new oil and gas exploration funding. Natural gas prices roughly tripled in the fall of 2021, but look at what that did —or didn’t do — to the drilling rig count (the number of rigs looking for new gas).

Figure 3

Baker Hughes Natural Gas Rotary Rig Count

This is where the last chapter has such significant investment implications. Typically, when the Fed is moving into a tightening cycle you don’t want to be heavily exposed to hard assets. Once again playing with the fire of “this time is different”, our precious central bank has never, ever been this far behind the inflation curve. This is taking into account both its nearly $9 trillion balance sheet — all funded with its MMM — and its overnight lending rate that is almost 6% below the inflation rate. Because it can’t catch up without crashing the system, the Fed will be in a perma-stimulus state for as far as the eye can see. There will be times when it talks tough and the market falls for its spiel but, realistically, it will be doing far more barking than biting. In fact, I think it’s now as toothless as an old turtle.

Similarly, there will be times when the U.S. dollar rallies, such as in 2021. Critically, those will be intervals when American investors, who are almost uniformly overexposed to dollar-based assets, will have a golden--literally, in the case of the yellow metal--opportunity to diversify out of it into assets that benefit from the debasement of our currency.

What would Rhett Butler do?

In the classic Civil War film, “Gone With The Wind”,[v] Clark Gable’s character made a cynical, yet profound observation: “I told you once before that there were two times for making big money, one in the up-building of a country and the other in its destruction. Slow money on the up-building, fast money in the crack-up. Remember my words. Perhaps they may be of use to you some day.”

While I admit it’s heartbreaking to think the U.S. could be going through an episode similar to the South as the War Between the States was ending very much to its disfavor, it’s not outlandish to consider. The fact that the U.S. government today is resorting to massive money fabrication to pay its bills is one haunting parallel. The reality that there is such intense national division, that at times seems to bordering on a stealth civil war, is at least another faint echo.

Yet, it is also critical to realize that the South not only survived its humiliating defeat but that within a matter of decades, or even less, it was booming. You may recall how rich Scarlett O’Hara became during Reconstruction (it helped that she was beautiful and married a wealthy man who would prematurely pass away… and, of course it was the movies). Moreover, almost 160 years later, the South may be the most economically vibrant, and fiscally sound, region in America.

Yet, perhaps a more relevant, though far more extreme, example is the Weimar Republic in Germany after WWI, as previously alluded to in this book. While that experience is well known thanks to the old newsreels of wheelbarrows of millions of marks being used to buy bread, the recovery after that is rarely studied. A new currency was created, backed by the nation’s physical assets, primarily land, and hyperinflation was defeated.[vi](For a hopeful take on how the US can potentially save its currency, please see the Epilogue.)

Whether it was the post-Civil War South or Germany in the early 1920s, people of wealth faced an existential decision. If, during those episodes, they loyally kept their assets denominated in their country’s currency, like in bonds or bank accounts, they were wiped out. If they recognized the gravity — and even depravity — of the situation, they were able to come out the other end of the crisis with their wealth largely intact. Further, they had the buying power to capitalize on the immense opportunities created by the chaos.

So, what would Rhett Butler likely be doing with his money if he was operating in the US in 2022? Here’s my best guesstimate on what his portfolio might look like:

Energy: Being the cagey character he was, Captain Butler would no doubt play both sides of this bet. He’d have plenty of exposure to renewable energy plays, especially those where there was a near certainty of extreme shortages. Of course, he’s also avoid overpaying, choosing to accumulate them after corrections and when bullish sentiment had cooled. The 2021 pull-back in copper prices was such an example.

He’d also likely come to the conclusion that traditional fossil fuels were a long way from being obsolete. He would almost assuredly realize that with countless entities--like college endowment funds, government retirement plans, and high-profile investment management companies--either totally eschewing fossil fuel investing, or seeking to minimize it for ESG reasons, shortages would be inevitable. Shortages naturally mean high prices and he would not hesitate to tread where so many other investors would not—at least until they realized that the world in 2022 was still exceedingly reliant on fossil fuels. The fact that he could receive dividends on his investments that were as high as 20% would only strengthen his resolve.

It’s also highly probable that he’d realize that decarbonizing the planet’s energy supply would require reviving nuclear power. Thus, he’d be on the lookout for opportunities in the largest uranium producers, as well as any company that had viable small modular nuclear reactor technologies.

Precious metals. Having witnessed the Confederate currency debased to nothingness, he’d have a natural affinity for precious metals. And since he’d always had a soft spot for cash generating investments, he’d be attracted to the miners thereof and their rising dividend yields. He’d almost certainly pick up on the fact that it was possible at year-end 2021 to buy an ETF of the best gold miners in America for half of what it sold for… in 2011!

International equities. Given his fondness for foreign trade, he would be willing to look overseas for far better bargains than in the hyperventilating U.S. market. He’d quickly pick up on the fact that while most American stocks were trading at record-breaking prices, including many producing huge operating losses, he’d prefer highly profitable companies in other markets selling for valuation discounts of 50% or more. He’d also realize that international value stocks were, in many cases even more alluring than those in the U.S.

Figure 4

Overseas bonds. It would be highly likely that he would put his bond investments in countries that were not practicing MMT which he would undoubtedly realize was eerily similar to what the South had done as it was losing the Civil War. He’d be attracted to the debt of nations running trade surpluses and modest budget shortfalls as opposed to the out-of-control status of America’s twin deficits. He’d also be inclined to store copious quantities of his cash in the currency of a country that has been a safe harbor for centuries. (More on that to follow.)

In addition to what he would do there are also critical things he wouldn’t do. To wit, he would refuse to:

Run with the blundering herd. Captain Butler always had a knack for spotting suckers, usually at a poker table, and he would for sure recognize the lunacy of millions of clueless amateurs recklessly throwing hundreds of billions around in 2021. In fact, the odds are high he’d have been shorting, or at least buying puts on, many of the stocks for which the Robinhood/Reddit/Wall$treetBets crowd was vastly overpaying.

Rely on a traditional balanced portfolio. Unlike most investors, the independently minded Butler would quickly pick up on the dangers of relying on a mix of 50% stocks and 50% bonds in a time of rising inflation. With real yields deeply negative even on 30-year T-bonds, he’d avoid them like the blockade ships he’d so frequently dodged. He’d perceive that long-term fixed-income investments were now positioned to increase risk, rather than lower it, particularly if the U.S. dollar got slammed, as he anticipated. He would seek his portfolio counterbalances through the aforementioned international bonds or gold.

Join the speculative orgy in crypto currencies. The combination of immense leverage and the mass dilution potential of the cryptos would almost certainly convince him that this was clearly a case of mass delusion. He might dabble in the scarce cryptos, like Bitcoin and Ethereum, when they plunged as the weak-handed suckers got flushed out, but he’d steer clear of the 6000 or so others that could be created as fast and furiously as Confederate dollars were in 1865.

Chase other absurd fads. He’d undoubtedly avoid like the plague that hit Atlanta as it was falling to the Yankees, all the acronyms that were attracting hundreds of billions, if not trillions, in 2021: IPOs, SPACs, and NFTs. Being the hard-boiled cynic that saw him emerge from the Civil War as a very wealthy man, he’d never want to own supposed assets that were utterly lacking in scarcity value.

Fall for the Fed’s faux-tightening rhetoric. Being congenitally suspicious of big government agencies and a believer in “watch what they do, not what they say”, he’d be a cynic when it comes to the Fed’s Put being totally kaput. More likely, he’d suspect the Put would kick in at somewhere around down 30% on the S&P vs the minus 20% that precipitated the “Powell Pivot” – the Fed Put in drag – back in early 2019. It’s further probable he would extrapolate the Fed’s increasingly aggressive market interventions, such as buying corporate bonds in March of 2020, and come to the conclusion it will buy stocks in the next panic. Thus, he’d likely suspect the Fed Put isn’t totally kaput, just modified to inflict more damage on speculators, thereby producing some political cover, before Jay Powell flinches once again.

Fleeing return-free risk While the above is obviously somewhat tongue in cheek, the underlying recommendations are not. It’s my belief that to navigate the increasingly turbulent conditions up ahead, anyone seeking to preserve real purchasing power needs to think like Rhett Butler. This is as opposed to all the Southern aristocrats who looked down on him and totally missed the impending collapse of their way of life.

Fortunately, modern America is in far stronger shape than was South in 1865. However, as I hope I’ve articulated through this book — and will further attempt to in the Epilogue, we are playing with fire right now — including the possible incineration of our currency.

In that regard and returning to my comment above on where Rhett Butler would likely keep a slug of his cash, my recommendation to wealthy Americans—and even those of modest means— is that they move a considerable quantity of their cash into Swiss francs. This is not to suggest using secret Swiss bank accounts. The objective it to avoid the probability of a crash in the US dollar that could start as soon as 2022.

With a profuse thanks to my great friend Vincent Deluard, whom I consider to be one of the most brilliant men I’ve ever encountered, I want to point out the stunning contrast between the economic fundamentals of the US and Switzerland. Unlike America, which now owes its foreign creditors far more than overseas countries owe us, if the Swiss called in their international loans the planet would need to send each citizen over $85,000!

In comparison to America’s nearly one trillion-dollar trade deficit, Switzerland runs a trade surplus, and its exports are growing at a double-digit rate. Instead of our 6% inflation rate (likely understated), Switzerland’s CPI is a mere 1.5%. From a fiscal budget standpoint, the divergence is also striking; instead of another trillion-dollar-plus deficit expected in the U.S. this year, the little Helvetian nation is projected to run a surplus.

It’s true that the Swiss franc has been rising for years, despite the Swiss National Bank’s reluctant use of negative bond yields and quantitative easing to hold it down. However, as Vincent points out, a drastic difference between QE Swiss-style and the versions applied in the US and Europe is that it buys other assets with the money it fabricates.[vii] Consequently, the Swiss National Bank has been accumulating US stocks for years and now owns $157 billion of them, about $17,400 for every citizen. It also has enormous gains on these holdings, at least for now.

Due to these outstanding fundamentals, the Swiss Franc does trade at a premium to the US dollar on the simplistic, yet surprisingly, accurate “Big Mac Index”. This compares the cost of Ray Kroc’s ubiquitous iconic creation in various countries as a means of determining relative currency over- or under-valuation. On this basis, the “Swissie” is 24% more expensive than the U.S. dollar. However, this is the lowest premium it has traded at in nearly a quarter-century. Shifting a substantial amount of your cash reserves into Swiss francs is, as they used to say in the glory days of Magic Johnson, a Laker lay-up. (There is a U.S.-traded ETF, managed by Invesco, that provides an easy way for Americans to hold Swiss francs.)

Similar to U.S. dollar-based cash reserves not being the safe haven they formerly were, at least when adjusting for inflation, the same is true with bonds, as Captain Butler perceives. Unfortunately, the overwhelming majority of U.S. investors seem either oblivious to this reality or prevented by mandate from taking protective action. (Please see the Chapter 11 Appendix for Charles Gave’s short essay on this; it is also applicable to a plethora of U.S. institutional investors who are forced to hold dollar-based bonds.)

Unquestionably, the eradication of yields on ultra-safe bonds, or what formerly represented total safety, as in U.S. treasuries, poses a serious problem for portfolio construction. A 60% stock/40% bond portfolio, or a 50/50 mix, or some other variation on the balanced theme, has been one of the most common asset allocations utilized for decades. Most of the bond component was made up of very high-grade issues. A key reason for that was to produce a stabilizing and counter-cyclical effect. In other words, when stocks were getting punched in the gut, top-quality bonds, especially treasuries, would rise in value as investors did their usual rush into safety during equity market convulsions.

Further complicating matters is the reality that during the last couple of years, treasuries have gone down along with stocks when there were serious dislocations. To this author, that is a strong indication there are beginning to be well-founded fears of the true safety of treasuries in terms of being repaid in non-depreciated dollars. As I’ve indicated multiple times in this book, using inflation to stealthily default on a portion of the government’s debt is the least traumatic way to deleverage our clearly busted national treasury’s finances. Accordingly, someone holding $100,000 of a 10-year T-note maturing in 2031 or 2032 will receive back something like $50,000 in terms of what that money buys today. There will be interest earned, of course, but that will almost certainly be less than the prevailing inflation rate between now and then. Ergo, treasuries offer a terrible investment proposition.

Fortunately, not all bonds have degenerated into certificate of confiscation status. This is particularly true overseas and, ironically, in many emerging markets. These former financial basket cases, at least in many cases, are now conducting monetary policies reminiscent of developed countries, before they/we discovered QE and MMT. Thus, the tables have been turned with the developing world, in many, certainly not all, instances protecting bondholders’ capital while most of the “rich” world is busily impoverishing them (all the while insisting this is just a temporary condition).

Yes, I know it feels weird to put bond dollar overseas and many of these markets are extremely hard to access for U.S. retail investors using individual securities. However, there are mutual funds and ETFs that do provide exposure to them. The Templeton Emerging Markets Income Fund (TEI) is a reasonable consideration in this regard. It provides broad exposure to a number of these bond markets. Our partner firm also runs a new fund with similar exposure, [viii] the Gavekal Asian Government Bond ETF (AGOV). In my opinion, diversifying internationally is one of the most important moves an American bond investor can make these days.

Returning to equities and how to avoid the coming reckoning for most U.S. stocks, the fact that almost all investors are so drastically underweight energy and precious metals securities there is, by definition, minimal downside risk. These two sectors/sub-sectors are my personal favorites and I freely admit I am in the opposition position of the investment community: I am massively overweight both of them. It really is true that a major oil and gas producer — with, arguably, the most prolific new reserves — is projected to pay a dividend yield of 20% or more. And that’s assuming much lower oil prices than today’s $100 plus level. (Over the course of 2021, I repeatedly wrote that crude would likely trade over $100 in 2022. Thanks to V. Putin, here we are; this is definitely not the catalyst I was anticipating. However, I do believe the $100 mark would have been blown through regardless. Should the West decide to totally cut off Russian energy exports, an oil price well over $150 is possible. That’s a disturbing scenario even for those with heavy energy exposure.)

Pushing one’s equity investment dollars overseas is critical for the reasons and factoids stated earlier in this chapter. The Japanese and South Korean stock markets look particularly attractive. Both sell at far cheaper valuations than the U.S. and each also benefits from money fleeing the Chinese stock market where that country’s policies have turned viciously against investors, both domestic and international. Each of these markets have also had major upside breakouts, a critical aspect I’d also like to bring up at this point.

Figure 5

[i] Per fellow newsletter scribe Ben Hunt, the World Health Organization switched out the next-in-line Greek alphabet letter Xi because it didn’t want to offend China’s dictator whose name, coincidentally, is Xi Jingping. Isn’t it considerate of them to be so sensitive?

[ii] This is the classic signature of a very late-stage bull market. The number of stocks making fresh highs shrinks down to a handful of the biggest and, presumably, best issues. This is technically, in a literal sense, known as bad breadth. In the case of the current U.S. stock market in late 2021, it was truly some atrocious halitosis!

[iii] As described in the Glossary of Terms, the “Fed Put” refers to its repeated easing actions during times of market stress; this famously began during the October 1987 crash when Alan Greenspan was head of the Fed.

[iv] By the way, the poster child for the current “new economy”, or disruptor, craze is the once white-hot Cathie Wood and her ARKK Innovation Fund is now down 51.9% from its early 2021 zenith versus the S&P up the same amount or a whopping 48% differential.)

[v] In real, inflation-adjusted terms, Gone With The Wind remains the highest grossing film ever.

[vi] The resulting prosperity undercut the revolutionary political aspirations of one Adolf Hitler and he wound up in Spandau Prison where he wrote Mein Kampf. Unfortunately, the good times in Germany came to an end when global stock markets crashed in 1929, ushering in the Great Depression and setting the stage for Hitler’s rise to power in the early 1930s.

[vii] You may notice an echo of my criticism of Social Security in this situation. Via its QE-based acquisitions of government debt, the Fed is merely transferring a liability from the Treasury to its balance sheet. Now that real yields are deeply negative even on 30-year T-bonds, it has become extremely costly to hold them in size. In an era of endemic inflation, long-treasuries have definitely attained return-free risk status.

[viii] Evergreen has no economic interest in the fund other than as investors in it on behalf of clients, as well as in my personal accounts.

absolutely terrific. Thank David