I Hate To Burst Your Retirement Plan Bubble

Chapter 13, Complete

The post-retirement society

Many social commentators, probably rightly, assert that Western culture is in the post-phase: Post-modern, post-religion, post-civility, post-bipartisan, post-patriotic, post-prudence, post-hope, post-tolerance and, perhaps, most inarguably, post-truth. But the “post” that is the topic of this month’s installment of Bubble 3.0 is based on the thesis that the relatively recent phenomenon of a comfortable retirement is now also increasingly a thing of the past.

One does not have to be a history major to know that it’s only been in the last four or five generations that most individuals were able to plan for financial security during their so-called golden years. In fact, it’s largely been since WWII that the idea of 20 or 30 years (or maybe 40 or 50, if you worked for the Federal government or the State of California) of financially secure leisure after retiring was anything other than a pipe dream for the average person. Unfortunately, we may well be in the process of going full circle in this regard.

One critical aspect that has increasingly gone “post” over the last few decades is the once sacrosanct defined benefit pension plan. (Government workers have largely been shielded from this shift but that may be changing.) In its place, the now nearly ubiquitous 401(k) has emerged as the main retirement asset-builder, especially for private sector workers.

At this point, a brief tutorial is in order. A “defined benefit” plan is exactly what it sounds like: a specific dollar amount per month is provided, typically based on years of service and income earned (up to a maximum threshold). The most familiar and popular version of this is, of course, social security. But in the pre-post-retirement era, it was common for millions of rich country workers to have some kind of guaranteed pension plan… at least if they worked for a medium-to-large-sized company or, of course, for their government. Unfortunately, particularly in the U.S., one of the casualties of the relentless effort by America’s corporate managers to drive down costs has been the once commonplace defined benefit pension.

The lengthening of American lifetimes, at least until recently, also played a role. Obviously, providing a monthly stipend became increasingly costly as life expectancies improved. Combined with the soaring costs of retiree healthcare benefits, U.S. companies tried to do whatever they could to lower their future liabilities. Since it was most challenging to try to get out from under the retiree healthcare burden, at least for current employees, the lower hanging fruit became the defined benefit plan. Thanks to a surging stock market in the 1980s and 1990s, the timing was ideal for a switch to a defined contribution model, typically the now nearly omnipresent 401(k).

The reason this worked so well in an epic bull market is because the high returns it produced accrued to the account beneficiary rather than the plan itself. You may recall it was quite common, especially in the 1990s, for those pension plans that were still in place to have become highly “overfunded”. This allowed companies to defer contributions, often for years, flattering profits. (Companies frequently adopted a two-tier approach where older workers were covered by defined benefit plans while newer and/or younger workers were sent into 401(k) plans. Often, veteran employees were able to keep their previously accrued defined benefit credits while shifting new contributions into 401(k)s.)

But once the tech bubble burst in 2000, it was an entirely new ballgame. Due to the fact that the S&P 500 had become heavily exposed to tech and telecom stocks by the end of 1999, with almost 50% of market value in just those two sectors, the 82% and 73% declines they experienced, respectively, caused the market to be basically cut in half. It was at that time we first heard the sardonic, but not entirely distorted, joke: “My 401(k) is now a 201(k).”

In the past, the ravages of a ferocious bear market would have hit a retirement plan participant’s company and not his or her own account balance. But, as my wife likes to say, “You can’t have it both ways”. Unfortunately, in 2008, after a few good years from 2003 to 2007, it was time for another 50% wipe-out. The 201(k) was back.

However, on the fortunate side, at least for those who didn’t panic during either the Global Financial Crisis of 2008/2009 or 2020’s Covid flash-crash, stocks have experienced one of the best 12 years in history. In fact, the rally has been so powerful that the S&P 500 has now returned % per year from the March 2009 trough.

Interestingly, though, going back to the start of the century/millennium, it’s been a not-so-grand or glorious 5.7% per year, showing the deleterious impact of the first 10 years, often referred to as the market’s “Lost Decade”. That twenty-year return was less than what long-term treasury bonds were yielding on 12/31/99 but at least it is now a positive number. As recently as 10/03/2011, it was still negative. (However, in gold terms, stocks are lower than they were at the end of the 1990s, illustrating how much of the last two decades of S&P returns are likely a “money illusion”.)

Readers with a facility for numbers might recognize there’s a glitch with that 5.7%, particularly for the remaining defined benefit pension plans, which includes virtually all state and local retirement programs. Because return assumptions have long been in the 8% to 9% range, a nearly 20-year output of less than 6% from what should be the highest returning portion of plan assets (at least for the publicly traded portion) is more than a bit problematic.

It’s also a safe assumption that most 401(k) plans have struggled to keep pace with this modest return since many participants have a nasty tendency to shift into stocks when they’re high and get out after big declines. Furthermore, being diversified in overseas equities has not been a boon. This is due to the fact that the main international benchmark, the ex-U.S. MSCI World Index, has generated a total increase of only 3.8% annually from the end of the 1990s to now. In fact, this index is still 18% below where it traded in 2007.

But back on the sunny side, bonds have helped offset this poor equity showing. Falling interest rates have produced unusually high returns. If one was savvy enough at the end of 1999 to buy a 30-year zero-coupon Treasury bond in their 401(k) — assuming they had that choice (many plans do not offer that option) — the annual gain would have been 9.25%. Other bond-type investments have generated very healthy returns, though not as lofty as a long-term zero-coupon treasury, since those benefit the most from falling – make that collapsing – interest rates. For example, the Merrill Lynch long-term corporate bond index has returned 7.6% per year since the start of the 2000s.

Of course, stocks, at least in the U.S., have been big beneficiaries of the interest rate implosion. This has allowed the S&P 500 to trade within spitting distance of its highest P/E ratio ever and at its loftiest price-to-sales ratio of all-time, as we saw in the last chapter (Chapter 14 will home in on copious amounts of stock market data, with the underlying message being: “Watch out below!”). But it’s a bit scary to contemplate what that sub-par 5.7% return over almost 20 years would have been without such a hurricane-force tailwind from crashing bond yields. Remember, per Chapter 11, we’re now living with the lowest interest rates in 5000 years. Perhaps it’s just my weird way of looking at the world, but I think that’s a rather extraordinary development.

Underscoring the magnitude of the uplift from rising stock and bond prices, particularly in America, please review another chart from a thoroughly illuminating June 23rd, 2021, report by BofA Merrill Lynch. It was pithily titled, Dr. Strange Dove or How You Learned to Stop Worrying and Love the Bond. If nothing else, this graphic points out one of the key rationales for my quixotic endeavor to write Bubble 3.0 and for asserting we are living through the third iteration of hyper-valuation over the last 20 years. Since this piece ran, the below metric has become even more dangerously extended.

Figure 1

Additionally, on the scare-inducing front, is what the overall pension plan funding status would look like if stock valuations weren’t so generous and bond returns hadn’t been unusually luscious. According to Moody’s, along with S&P, one of the two main bond rating services, state and local retirement plans are underfunded to the unpleasant tune of $4.4 trillion. The Fed believes the shortfall is over $6 trillion. To put this in perspective, total state and local government revenues are $3.1 trillion. (Data as of 2019)

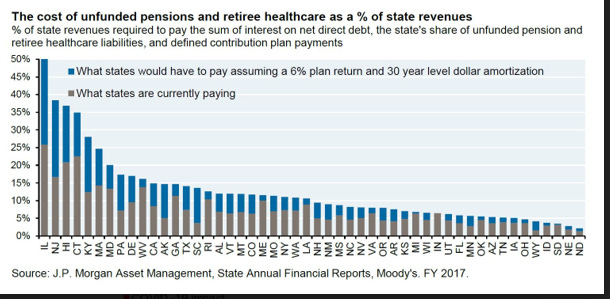

Financial newsletter guru John Mauldin observes, quoting the American Exchange Council, that these plans have only about one-third of the assets they need to fund future benefits. Specific states like Illinois and New Jersey are in such deep holes that a recent JP Morgan (JPM) research piece called their dire conditions “practically irreversible”. To back this up, JPM’s Michael Cembalest ran this graphic showing the percent of state revenues that would need to be dedicated to paying retiree pension and healthcare benefits using lowered but still unlikely-to-be-attained assumptions. Please notice the difference between the blue and brown bars, with the former based on a much more plausible 6% assumed return (more to follow on that point).

Figure 2

The great state of California and the U.S. Federal Government are also interesting case studies on the dangers of rocketing and unfunded entitlements. Thanks to increased taxes on California’s wealthiest, and the capital gains windfall from inflated stock and real estate prices, the Golden State is running a hefty surplus. The federal government has been another crucial source of deliverance, sending $ billion in aid to the state. It has now swung from an estimated $50 billion deficit in the Covid-wracked year of 2020 to a $75 billion surplus for 2021. Yet, there is a powerful storm lurking off its beautiful coastline.

Firstly, its massive public employees’ retirement entity, CalPERS, is only 71% funded despite using a lowered, but nonetheless improbable-to-be-realized, 6.1% return (more to follow on this topic, as well). This is also despite the fact that all the revenue from the “Millionaire’s Tax Initiative” California enacted in 2012, that raised the top rate from 10.3% to 13.3%, has been used to cover retirement benefits.

Secondly, and likely most significantly, Medi-Cal is becoming a tax revenue sinkhole — both for state and national taxpayers. Medi-Cal, California’s version of Medicaid, the health program for the poor, now covers nearly 14 million people, roughly one-third of its total population. It “boasts” an annual budget of $100 billion, three times Illinois’ overall budget. Enrollment is swelling, despite a resurgent economy.

As Medi-Cal has grown, so have emergency room (ER) visits. These vaulted by 75% from 2011 to 2016 which cost, on average, five times as much as a regular doctor visit. Often, trips to the ER are for routine illnesses. ERs are so clogged that Californians are told that if they truly need urgent care, they should call 911 and be taken in an ambulance since this puts them at the head of the ER queue. Obviously, the waste from all the above is immense. Even if you don’t live in California, you should care since the federal government roughly matches what the state spends on Medi-Cal (other states with lower income get even bigger Federal subsidies).

A rabbit hole with no bottom

There seems to be a belief that Federal deficits and spending gone wild is of no import. This is particularly the case with socialists and quasi-socialists. They are proposing enormous new entitlement programs on top of what were already unprecedented budget shortfalls — 5% of GDP or $1 trillion – in an economic expansion under Donald Trump.

Of course, post pandemic the deficits went totally bonkers (like, it seems, so much in our world today). In the federal fiscal year 2020 (again, this ends on September 30th), the budget shortfall was $3.1 trillion. But what happened next was even more astounding…

For fiscal 2021, the U.S. government ran a $2.8 trillion deficit despite real GDP growth of 5.8%, about three times a good year in the post-financial crisis era. That was out of a total revenue base of $4 trillion! Spending was $6.8 trillion so the government spent about 70% more than it brought in and ran a deficit of 70% of its revenue base. At least it’s consistent with the 70% part.

Accordingly, since the pandemic, it has added nearly $6 trillion to the national debt in just two years. Incredibly, the $2.8 trillion red ink in 2021 was despite an 18% revenue surge to the highest ever.

It’s fair to note that backing out the mind-blowing federal largesse, the economy would have been at stall speed. A $2.8 trillion deficit is basically about what GDP increased nominally (i.e., including inflation). Thus, in the absence of the budget blowout, the U.S. economy would have had a mild recession. Maybe it’s just me but I think that would have been a far better outcome than totally destroying our national balance sheet and opening the door to high inflation. Yet that’s not the main point of this chapter.

What is germane is that federal government entitlements — which are, naturally, off-balance sheet and unfunded — are estimated to be around $150 trillion currently. (However, on a present value basis they are considerably lower, though still so large as to be impossible to fund.) In many ways, the federal government is the worst offender in this regard. Even basket-case states like New Jersey have some portion of their retirement obligations funded by actual assets. But not the U.S. government. As I’ve written multiple times in my newsletters, the vaunted Social Security “trust fund” is most untrustworthy. There is nothing in it but federal IOUs. Imagine if New Jersey tried to fund its entitlements entirely with its own debt obligations.

It continues to be my contention that failing to invest the multi-trillion-dollar surpluses Social Security accumulated since the 1980s into a diversified portfolio of corporate stocks and bonds was one of the greatest policy errors of the last three decades. And, it’s no exaggeration to say, there is a long list of those to choose from.

Gene Epstein, a former long-time columnist for Barron’s, is one of the very few I have seen comment on this incredible blunder. This is an excerpt from an article he wrote in September 2017, which is even more true today: “There could have been a bona fide trust had the surpluses generated for many years by Social Security been invested in other assets, in the same way countries maintain sovereign wealth funds. Instead, all the surpluses were spent, and IOUs known as Treasuries were created in their place. The term ‘trust fund’ is thus a form of Orwellian Newspeak: no fund, and surely no trust.” Maybe this should create another “post”, as in post-trust.

Medicare and Medicaid also have no assets, other than the payroll taxes they collect which are already falling several hundred billion short of outlays, requiring the Federal government to come up with the rest. This deficiency is almost certain to continue to grow barring significant tax increases.

None of the local, state, or federal entitlement situations are sustainable. Yet, as mentioned, even more enormously costly social programs are being proposed, on top of Donald Trump’s “yuge” corporate tax cut that further impaired Federal revenues. This is one of the reasons, along with spending gone viral under what was a totally GOP-controlled government in 2017 and 2018, that in 2019 the all-in deficit was over $1 trillion. This is based on what was actually borrowed, not just the official shortfall.

This was despite a relatively robust economy in 2019, at least by recent anemic standards. And, of course, this excludes all the aforementioned unfunded entitlement obligations which are now going to require real money outlays as the Boomer generation moves from partially to mostly retired. This will be particularly painful since, as noted, there is no bona fide trust fund to cover these payments.

This is another area where our policymakers have totally relinquished any fiscal credibility they have left. Of course, they’ve been greatly aided and abetted by the Fed which has allowed the US government to spend trillions it doesn’t have with — for now — zero adverse consequences, other than the now nagging inflation problem. Frankly, I think the lack of faith and confidence in our nation’s leadership, at multiple levels, is one of the gravest threats we face right now.

This terrifying situation is far more than a U.S. problem. Globally, the retirement funding shortfall (which some refer to as “the savings gap”) amounts to $70 trillion, and that was back in 2015. By 2050, this is projected to be $400 trillion. As in America, the demographics are daunting. Worldwide there are now 600 million souls over 65 years old. By 2050, that age cohort is projected to rise to 2.1 billion. The inescapable reality is that the planet’s pension systems were built under the assumption that people would live roughly 15 years in retirement; instead, more and more are living 30 to 40 years after retiring. (In the United Kingdom, as of late 2019, its national retirement fund was underfunded by five trillion pounds on a seven trillion pension system!)

Right before Covid made its world-terrifying appearance, the non-profit Employee Benefit Research Institute estimated that Americans between the ages of 35 and 64 were looking at a $3.8 trillion retirement savings shortfall. It forecast that 41% of U.S. households would face an investment asset deficit in their later years. (Source: The Wall Street Journal, 12/20/19)

As bad as all of the foregoing is, the actual predicament might well be worse. This is where the repercussions of Bubble 3.0 come into perverse play, and it relates to the previously mentioned unrealistic return assumptions. As you can see below, per the National Association of State Retirement Administrators, the assumed rate of return for U.S. defined benefit (DB) plans has been reduced by a miniscule ½% over the past 19 years, from 8.05% to 7.56%. And that original return assumption of roughly 8% was made in 2002, when corporate bond yields were in the 7% to 9% range and U.S. stocks were yard-sale cheap. Can you say nonsensical?

Figure 3

Showing how desperate some plan sponsors have become, the Pennsylvania Teachers’ Retirement Fund has shifted over half of its assets into aggressive investment vehicles. As reported by the New York Times on May 12th, 2021, this included pistachio farms and payphone systems in prisons. Notwithstanding this higher risk pivot, its performance has still fallen short of expectations. It also overstated returns, necessitating teachers who were hired in the past decade to increase contributions for the next three years. This accounting flub has even attracted the attention of the FBI.

This is a monstrous problem that has been festering for years. The Stanford Institute for Economic Policy Research reported in 2017 that for the years 2008 to 2015, the aggregate unfunded liabilities rocketed from $2.63 trillion to $5.6 trillion. And, as my friend John Goode noted, a long-time senior portfolio manager at Morgan Stanley and author of the piece containing this factoid, that was during a ripping bull market. Despite that, unfunded liabilities compounded at an 11.4% rate.

The main theme of Chapter 11 was the inarguable fact that bonds are the most expensive — hence, they are the lowest yielding — of all-time. The chart in that chapter showing yields at a 5000-year low should be all the proof needed to validate this view. If you need more, consider that, as I write this, there are still around $4 trillion of bonds around the world with negative yields (down from a peak of $17 trillion in the summer of 2021). (Note, I cut the next couple of sentences due to changing market conditions.)

Even in the U.S., one of the higher – make that “least lower” – yielding developed countries, the 10-year treasury note yields less than 1.8% (though, I suspect, not for long). This is despite the prevailing 5% to 6% de facto CPI, as evidenced by the 5.9% cost-of-living hike for social security recipients in 2022. As a point of reference, during the worst days of the Great Depression, the lowest 10-year T-note return hit was 1.9%, when consumer prices were falling — hard!

Invariably, when I’ve discussed the topic of negative-yielding bonds with clients, I’m often asked a simple and rational question: “Why would anyone buy a bond where the lender pays the borrower?” To answer that question, I’ve included a brief excerpt from one of my intellectual heroes, Charles Gave, on precisely this topic.

To wit: “When meeting some clients a few weeks ago in Amsterdam, I made my usual remark about the stupidity of running negative interest rates. In response my host told me a sobering story. He manages a pension fund and had recently started to build large cash positions. One day he was called by a pension regulator at the central bank and reminded of a rule that says funds should not hold too much cash because it’s risky; they should instead buy more long-dated bonds. His retort was that most eurozone long bonds had negative yields and so he was sure to lose money. ‘It doesn’t matter,’ came the regulator’s reply: ‘A rule is a rule, and you must apply it.’ Thus, to ‘reduce’ risk the manager had to buy assets that were 100% sure to lose the pensioners’ money.”

(If you’ve got the time, you should read Charles’ full piece to which we’ve placed a hyperlink in the Appendix. It's only a little over a page long and it describes how negative-yielding bonds are a cancer eating away at Europe’s entire savings industry, with truly disastrous long-term implications.)

Because bonds are such a vital part of retirement plans, this yield extermination is an unmitigated disaster for these “schemes”, as the Brits call them. The same is true for those 600 million 65-and-over global investors. Income from fixed-income investments has been a mainstay of portfolios since the end of WWII, if not even earlier.

Neutering yields from bonds has essentially created a massive wealth transfer to hedge funds, private equity firms, and all those entities that can afford to take on high risks, and away from retired and wannabe retired investors (who are “gonna, wanna” for a lot longer thanks to yields gone missing). Further, hedge funds, et al, typically use leverage to goose their gains. And, of course, U.S. corporations have also “debted-up” to buy back shares, inflating stocks prices and senior management option packages, per Chapter 12.

As you can see below, the world has been on a debt bender that is without precedent. Go figure—central banks destroy interest rates and the planet gorges on debt! What a shock!!

Ok, so it’s LCD clear that fixed-income should be renamed “nixed-income” and can’t be counted on to produce anything close to normal yields for years to come. So then, it’s up to the stock market, real estate, as well as alternative investments, like private equity and credit, to bring home the bacon or, perhaps these days, the vegan sausage. The problem is that all these asset prices have already been driven up to levels where future returns are highly likely to be disappointing. (This is truer in the U.S. than overseas, where stock and real estate values are often much more reasonable but, paradoxically, bond prices are much higher — and, thus, yields far lower – than in the States.)

If you don’t believe me on the disappointing return part, the prestigious market analytics firm Ned Davis Research has back-tested Warren Buffett’s favorite long-term stock valuation metric, total capitalization compared to the size of the economy, over the past 94 years. In their words, “no indicator we’ve tested has done better than this historically when looking out 5 to 10 years”. The sobering news is that on this basis they project stocks to produce a string-bikini skimpy 1.4% over the next decade, likely even less given the latest market up-move, which serves to reduce future returns.

A bit more encouragingly — but not much — the late and very great Vanguard founder Jack Bogle predicted a lowly 3 ½% annual return over the upcoming 10 years from a blended stock/bond portfolio. And that was back in 2017 before prices moved even higher. Consequently, the miniscule Ned Davis number for stocks could be closer to the mark.

With the trillions of dollars from return-starved pension plans flowing into private equity, it’s hard to believe that area will be able to provide its historically high returns. For a time, that might not be apparent, as they are presently able to sell businesses they took private years ago into a hyperventilating U.S. new-issue market, realizing big profits. But that window won’t stay open indefinitely. Too much money chasing too few superior opportunities has never ended well in the past and I don’t expect it to this time, either.

To close this chapter of Bubble 3.0, I’d like to attempt to drive home the point that the entire paradigm of central banks forcing interest rates down to nothing, or less than, is a dagger to the heart of retiring Baby Boomers around the world. Not only are their portfolios almost certain to produce inadequate returns to maintain their lifestyles, unless they are wealthy in the extreme, their pension plans are also at risk. Benefit cuts are nearly inevitable though, undoubtedly, politicians will do all they can to delay the reckoning, thereby worsening the eventual pain.

A lack of safe returns and the escalating threat to pensions (as well as healthcare benefits) is a terrible double-whammy. Consequently, the odds are high that the golden years will be anything but for tens, even hundreds, of millions of people. Perhaps that’s why the percentage of Americans aged 55 to 64 who are still working has risen from 56% in 1990 to 65% today. It’s a pretty safe bet that number will keep climbing once we have the next bear market and Boomers are left with the worst of both worlds: a devastated equity portfolio and the present reality of negative bond yields net of inflation. (Covid has been reversing this trend for a variety of reasons--including return to workplace fears, vaccine reluctance and a roaring stock market--but, as the bitter economics become obvious, it is likely to resume.)[i]

When I first wrote this chapter back in 2019, I conceded that deflation fears might return once again, as they did after the financial crisis. If so, buying a 10-year T-note at a 2% yield might look smart... for a while. And for a brief time, during the most extreme Covid lockdowns, that’s exactly what happened with the yield on the 10-year T-note crashing to 0.5%. However, I opined it would probably have a short shelf life when I wrote these words: “That is until the powers-that-will-be, whether from the left or the right, decide to try something like Modern Monetary Theory (MMT), ejecting what’s left of fiscal prudence out the window.” Of course, that’s exactly what has happened, but far faster and to a much greater degree than even I anticipated and feared.

Returning to the opening theme of this Bubble 3.0 installment, it’s a most post world we find ourselves in today. Along with post-truth, perhaps another profound “post” is sanity. And, believe me, it’s no fun to be one of the few sane “guests” in an insane asylum, especially one that offers an extended stay package worthy of the Hotel California.

[i] One wise man, quoted by my friend, acclaimed financial commentator and investment newsletter scribe Danielle DiMartino Booth, believes that over the next decade one-third of those turning 65 will be in poverty. If so, it’s hard to believe all these folks, and even those who are one or two rungs up on the wealth ladder, will be free spenders. That’s certainly a factor in favor of the low inflation argument but the flipside is aggravating the already acute labor shortage—at least until the older set realizes they need to keep working longer, probably much longer.