History’s biggest financial bubble: Who blew it and how to protect yourself when it blows apart.

Prologue + Chapter 1

Mt. “Cashmore”

Prologue

How did it happen? How did the United States of America slide so far, so fast? Two decades is less than 10% of this nation’s history and yet in that comparatively short time the degeneration of America has been shocking. Whether regarding its finances, its social contract, its adherence to the rule of law, its respect for a two-party system, its reverence for free speech, its tolerance of dissenting views, its trust in its political leaders, its desire to reduce wealth inequality, or its perception of its own moral character, all have devolved to a degree that leaves most Americans depressed and deeply apprehensive.

Answering how this all happened requires a very complicated response. There have been numerous pernicious forces at work, some external and many internal. On the former score, 9/11/2001 was unquestionably a major pivot point. It not only destroyed our sense of security, it triggered two wars that added trillions of dollars to our national debt… and most of that back in the days when a trillion dollars seemed like a lot of money. Far worse, countless lives were lost or permanently impaired as a result of the conflicts in Afghanistan and Iraq, along with the spillover conflicts in countries like Syria and Libya. The merciless organization ISIS came into being almost certainly as a result of America’s Middle Eastern military interventions.

But the focus of this book is on the role that the U.S. Federal Reserve played in our painful national decline. It goes without saying, or writing, that the Fed, as it is popularly known, did not intentionally precipitate this unfortunate outcome. Nevertheless, it has repeatedly resorted to extreme monetary policies since the late 1990s tech bubble imploded. It has also consistently asserted that these radical measures were temporary. Yet, other than for brief periods, especially since 2008, it has maintained them, lending credence to the old saying by Milton Friedman (and Ronald Reagan) that there is nothing so permanent as a temporary government program.

The goal of this book isn’t to assign blame, though there is an abundance of that to go around. Rather, it’s my contention that objectively evaluating what the Fed has done — and the long-term ramifications of its actions – is essential in determining if it played a key role in America’s twenty-year deterioration. If so, a radical overhaul of the Fed is needed before it inflicts even more damage in terms of bubble inflations and social stratification.

Undoubtedly, many will question characterizations like decline and devolution but, in my opinion, most will not. It’s painfully obvious in early 2022 that the majority of Americans are scared and pessimistic. Certainly, the Covid pandemic that’s still raging as I write these words was another external shock and one that continues to plague us (literally). It has just as certainly been a huge factor in the national sense of despair. But pandemics all end, and we are much closer to the conclusion of this terrifying experience than the beginning (barring the apocalyptic scenario that variants develop a resistance to both vaccines and natural antibodies among the previously infected).

Once the virus crisis is largely in the past, however, its toxic impact on our country’s finances will remain. The virtual lockdown of the U.S. economy required deficit spending on a scale not seen since WWII. As a result, our federal debt-to-GDP ratio now stands at the highest ever, other than a year ago when it briefly hit 135%, above what it was even in 1945 after both Germany and Japan had surrendered. (The fact that it has now receded to 122% of GDP is a key part of this book and will be examined in detail in Chapter 17.)

The six trillion dollars of U.S. government deficit spending that has occurred over the last twenty-one months — from March of 2020, when Covid first went viral, until the start of 2022 — necessitated the Fed to do something called debt monetization. This is the technical term for a central bank buying up its own government’s bonds.

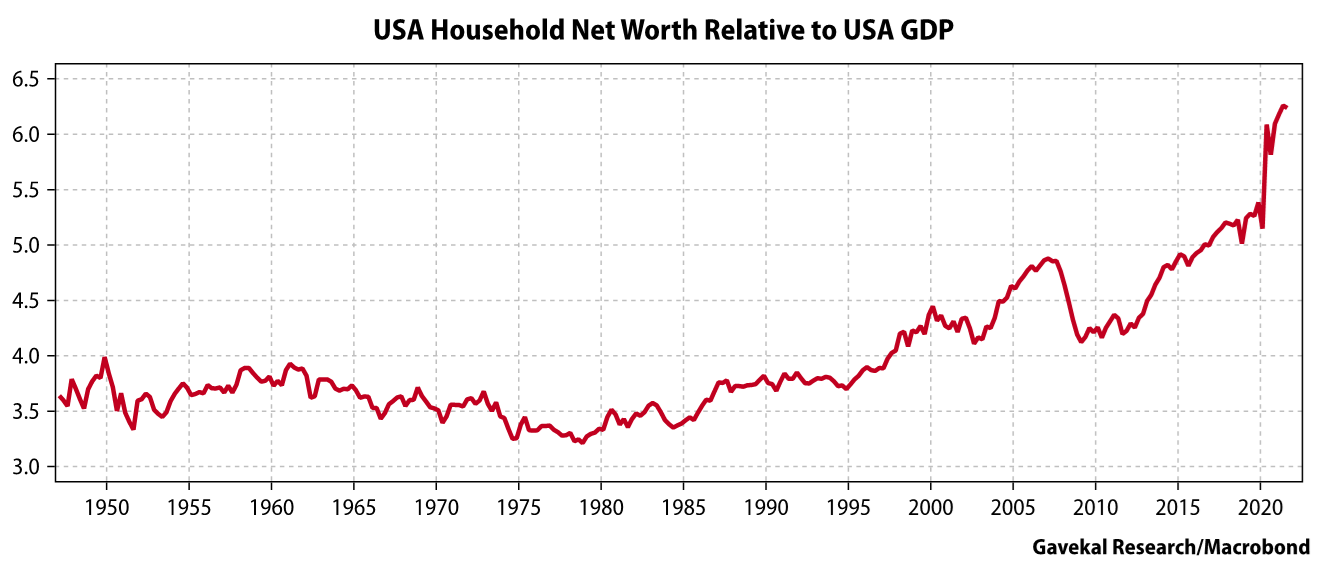

What makes it particularly alarming is that these purchases have been made with the Fed’s high-tech equivalent of the printing press: the creation of digital money, or reserves, simply fabricated from its very special computers. (Don’t we all wish we had one of those!) In my newsletters over the years, I have referred to this as the Fed’s Magical Money Machine. And when it comes to asset prices like stocks, bonds, real estate and, even, cryptocurrencies, it has indeed worked magic. Perhaps the correlation shown below is a coincidence, but this book will contend the opposite.

The Fed has been joined in this debt monetization and money fabrication scheme by virtually every major Western central bank, so it is very much an international phenomenon. This process will be examined in more detail in subsequent chapters. (Please note the Glossary of Terms that accompanies this Prologue, as well as the Cast of Key Characters; you may want to print this out to have it easily accessible as you proceed. Each chapter also has an appendix where additional data or context is provided to avoid slowing down the pace of this book.)

The initial publication of this project actually involved my financial newsletter called the Evergreen Virtual Advisor (EVA) which I’ve written since 2005. It ran via roughly monthly installments from December of 2017 until May 1st, 2020.

What caused me to begin this effort in late 2017 was the speculative frenzy that engulfed Bitcoin and the other cryptocurrencies at the time. Even back then, Bitcoin had eclipsed every prior financial bubble (remarkably, unlike any other prior bubble in recorded history, it, and the other cryptos, have re-inflated to yet more astronomical levels; this extraordinary development will be a focus in Chapter 10). As with the dotcom craze of the late 1990s, Bitcoin in the second half of 2017 had captured the imagination of millions of Americans — along with billions of their investable dollars.

That first edition of the Bubble 3.0 series went out just as the incredible crypto mania hit its crescendo. Its peak almost perfectly coincided with the publication of the first chapter of this book in its on-line form, which is most uncharacteristic of me. Usually, my warnings are early – sometimes years early.

There are many financial experts who object to referring to what’s happening in markets today as a bubble. Frankly, I think that is an indefensible view. In fact, recent years have seen the inflation of so many bubbles that I’ve half-jokingly told friends and clients that perhaps I should rename this book Bubble 33.0.

It is true, however, that not all stocks, or other investments, are in a bubble. There are many reasonably priced equities even in the U.S. market which has been by far the strongest — and frothiest – of any developed country over the last decade. Yet, that was also the case in the late 1990s; actually, there was a much larger contingent of cheap stocks in the U.S. market in early 2000, as the biggest equity bubble in America’s history was poised to explosively pop.

As a reminder, the tech implosion that began in 2000 took the star performer of the 1990s, the NASDAQ, down nearly 80% by 2003. (Ironically, this is almost precisely how much Bitcoin fell once its 2017 bubble burst.) For those who had pivoted away from the hyper-popular tech stocks of that era, the vicious bear market of 2000 to 2003 was a minor blip, even as the more diversified S&P 500 plummeted 50%. This book proposes that a similar episode lies ahead. In fact, based on market action in early 2022, it may be already unfolding.

Optimists often point to the ebullient U.S. stock and real estate markets as a contradiction to the belief that America is in a structural decline phase. But, in my view, this ignores the primary driver of extremely elevated asset prices: the Fed’s Magical Money Machine. This is something I will delve into in more detail in Chapter 6.

Along similar lines, Chapter 11 focuses on bonds and the role fixed-income instruments have played in pushing stocks and real estate up to unparalleled valuations. For now, suffice to say that the lowest interest rates in 5000 years have pumped a long list of asset classes (like stocks) full of enough helium to fill the planet’s skies with Goodyear blimps. In other words, don’t confuse an artificially induced boom with true prosperity.

Unsurprisingly, the pundits who most strenuously disagree with my skeptical view of the sustainability of the current rampaging bull market in almost everything are those who have championed an economic model called Modern Monetary Theory (MMT). This will be discussed in Chapter 1, and much more extensively in Chapter 6, but, for now, simply realize MMT is what we are practicing in this country presently. Ironically, some leading economists, such as Nobel prizewinner Paul Krugman, who once derided MMT, are now among its most ardent defenders.

Another irony is that despite MMT being primarily, though not exclusively, embraced by progressives, it is serving to further exacerbate the wealth inequality situation in this country. The history of prior MMTs is that they consistently lead to high inflation. As we are seeing today, rising inflation often raises the cost of life’s essentials the most, thereby inflicting the greatest harm on the poor.

Along with analyzing why central banks have been unable to kick the money fabrication habit after all these years, as well as the impact this has had on markets and society at large, I am going to suggest investor protection strategies. These will have a much different character than the one that has worked so well during equity bear markets and deep corrections of the last forty years – namely, long-term U.S. government bonds.

We will also look at how the U.S. is likely to extricate itself from the debt trap into which it has plunged — with considerable help from a Fed whose money printing and war on interest rates have enabled previously unimaginable deficit spending. History has many examples of how this can be done but, unfortunately, these resolutions are definitely not pain-free.

While I don’t pretend to be clairvoyant, my anticipatory track record has been respectable. In addition to warning about the ultimately doomed tech and housing bubbles, I also opined that the odds favored the last three recessions not long before they ensued. The last two of those forecasts, plus my extensive criticisms of the housing/mortgage mania of 15 years ago, were documented in numerous EVAs and are available on the Evergreen Gavekal website. (Some of which will be hyperlinked along the way.) The Fed, I should point out, with its immense resources, has managed not to call a single recession, before the fact, in its century-plus history.

On the humbling side, Bubble 3.0 — or 33.0 — has gone on much longer than I believed possible. Fortunately, during the nasty downturns we’ve had, even as this bubble-without-precedent — especially in terms of duration — has refused to pop, Evergreen has been able to capitalize on them, particularly during the pandemic panic.

Obviously, America has a long history of overcoming extreme adversity. But this current cohort of U.S. policymakers all too often treats its citizens like juveniles who cannot handle the truth. Consequently, hard choices are continually deferred, and failed policies are covered up with ever larger amounts of debt creation. While it is naïve to think that we can reverse two decades of irrational and harmful policies without hardships, there is always hope for a better future once we realistically address our multitude of challenges.

Fortunately, Americans still have the right to throw their mostly hapless and hopeless “leaders” out of office. In this regard, there is mounting evidence of what I’ve begun referring to as “The Great Pushback”. This is occurring with increasing frequency against both far-left and far-right politicians, who have, despite (or maybe because of) their sensationalized and theatrical rivalry, done so much to harm America. In my view, the vast majority of Americans want to make our country sane again. And, I believe, that needs to start with our ever-more powerful — and ever-more reckless — central bank.

Until the Fed is reformed and restrained, prudent investors need to be realistic, taking the necessary steps to protect themselves from the detonation of Bubble 3.0’s fallout. The good news is that it’s eminently possible to do so… but not with the investment strategies that have worked wonderfully for the last 40 years. To find out what those are, well, you’ll just need to keep reading!

Chapter 1: Birth of a Bubble Nation

No inhibitions

In attempting to identify a Bubble 3.0 starting point, it is only logical to reflect back on how we arrived at our present situation of unprecedented central bank involvement with financial markets. We must also consider the uniqueness—and latent danger—in the reality that most developed country governments have utterly trashed their balance sheets over the last dozen years. This was the case even before the pandemic panic struck; since then, sovereign indebtedness has hit end of WWII-like levels.

Prior to Covid, I had written in the real-time Bubble 3.0 (published in monthly installments via our EVAs) that the degradation of most developed countries’ balance sheets from 2009 through early 2020, left them with limited options for the next crisis. This erosion occurred despite a sputtering but long-lasting economic expansion. COVID was, of course, a disaster of nearly Biblical dimensions (this is no exaggeration, since plagues played a starring role in the Old Testament!).

In Chapter 2, I will elaborate on how central banks coped with Covid. However, for now, let us zero-in on what central banks did in the decade between the Global Financial Crisis and the pandemic. (Ironically, “zero” is an apt word.)

If I had been so imprudent as to have speculated back in 2007 that, over the upcoming decade, the Fed would resort to four separate rounds of QE[i] my readers would have reasonably concluded I had lost it totally.

But Quantitative Easing (QE) was just the first loss of the Fed’s monetary virginity. Modern Monetary Theory, or MMT, has taken its fall from respectability to an entirely new, and far more dangerous, level. While QE and MMT are related, it is fair to think of the latter as burlesque while the former is a full-on striptease – sans G-strings – with all sense of propriety abandoned.

While the former created trillions of dollars of pseudo-money (what I sometimes refer to as “pseudough”), it was not effective at getting it into the economy itself, as opposed to allowing, even encouraging, it to leak into asset markets like stocks and real estate. But MMT involves the semi-direct financing of multi-trillion-dollar Federal government outlays to consumers and businesses. This is why, for the first time in U.S. history, household income rose during the short, but brutal, Covid-caused recession.

Basically, MMT is much more potent than QE and, in my opinion, much more inflationary. (As a side note, twelve years ago, when QE I was first launched — yes, they do sound like ocean liners — I argued with the many pundits who felt it would be highly inflationary.)

QE and MMT are such important topics that they richly deserve, and will get, their own chapters. Thus, for now, I’m putting an in-depth discussion of those on hold. Yet, they absolutely fall under the heading of things that would have been impossible to believe in 2007, prior to the explosive bursting of the late, not-so-great, housing bubble. As we shall soon see, that event changed everything… and for the much, much worse.

It was the massive mania in homes and, especially, mortgage lending that first caused me to begin writing our Evergreen Virtual Advisor (EVA) in 2005. Part of my motivation for doing so was to go on record with repeated (and, as it would turn out, repeatedly strident) warnings about the extreme dangers of that unprecedented inflation of home prices. I was even more adamant about the grave risks of the maniacal mortgage machine that was feeding it. This was what I think can reasonably be referred to as “Bubble 2.0”.

Candidly, I felt I had missed my chance to be more vocal about the first mass mania of the last quarter century: the intoxicating tech bubble of the late 1990s. In my view, there is little doubt this qualified as “Bubble 1.0” and it is generally considered to be the greatest stock mania in US history. While I warned all my clients back then about its perils, I didn’t have a public platform through which to do so. The firm I was employed by at the time, Smith Barney, was also highly unlikely to let me take such a vehement and unpopular stand (telling investors they are about to get fleeced is never great PR for a large brokerage house). Accordingly, I will always feel like that was an opportunity lost.

However, as anyone who read our EVAs back then can attest, I didn’t pull any punches on Bubble 2.0. (Here’s an example of one from that era: link to the November 2006 EVA, Derivatives in Distress) As continuous and shrill as my warnings were in those days, they actually weren’t equal to the calamity that was to engulf the world after Labor Day 2008. That September was the nightmarish month when Lehman Brothers, AIG, Washington Mutual, Freddie Mac and Fannie Mae all either literally collapsed or were prevented from doing so only by radical federal government intervention.

It still gives me a fleeting sense of panic to think back about how terrifying those times were and not just in the U.S.; it truly was a global financial pandemic. Perhaps it was a horrific sneak preview for the actual pandemic that was to strike the planet almost a dozen years later. In both cases, by the way, neither the Fed nor Wall Street saw what was coming, even as evidence mounted of the impending catastrophe.

With Covid, the window was very small for preventative measures and its ferocity was extremely hard to imagine for non-epidemiologists. But there were those of us who did get worried enough to hunker down early in the pandemic. In the case of the great housing bubble, though, there was plenty of time and abundant evidence of the escalating disaster. Consequently, free passes should be sparingly given. As another QE, Queen Elizabeth, asked her government’s best and brightest ex post crasho: “Didn’t anyone see this coming?”

Well, actually, many of us did, as brilliantly recounted in Michael Lewis’ mega-hit The Big Short. (Personally, I give copious credit to John Mauldin and David Rosenberg, both of whom played a huge part in alerting me to the impending disaster.) The problem was that most people, especially those in a position to do something about it, didn’t pay any attention to us.

Fed Chairman Alan Greenspan famously — make that, infamously — encouraged U.S. home buyers to use adjustable-rate mortgages… even as he was raising interest rates! His successor, Ben Bernanke, said more infamously yet that the unfolding fiasco in sub-prime mortgages, which had become obvious by the third quarter of 2007, would be “contained” within that dodgy part of the lending world. Citigroup CEO Chuck Prince covered himself in ignominy by declaring his bank would “keep dancing as long as the music was playing”, referring to his intent to keep funding the mania that was happening in nearly all forms of lending in the summer of 2007. Once proud Citigroup saw its stock price fall from the fifties to a mere dollar by early 2009, showing the extreme hazards of dancing too long during times of mass imprudence. As with most big U.S. banks, only gargantuan government support allowed it to survive.

This is a critical reason why Bubble 2.0 turned out to be so much more lethal than Bubble 1.0; namely, it involved the banking system. Banks were brimming with questionable loans by mid-2007. The toxicity not only infected the U.S. financial system but had spread to most of the developed world. Once the dominos started tumbling, it looked for a time like they would never stop. There was a real risk of another Great Depression as large banks all over the world were on the brink of failure. That’s why such credit-fueled manias are the very worst kind of bubble.

Bubble blind… again & again

How was it that such a multitude of people who should have known better, could have been so clueless about the escalating dangers? With the advantage of hindsight, it’s now clear that Bubble 2.0, and particularly its disastrous demise, would sow the seeds for Bubble 3.0. And though some no doubt would challenge the linkage – often those who continually deny the existence of bubbles in the first place – the evidence is strong that the speculative frenzy around tech stocks in the late 1990s initiated the chain reaction that would ultimately lead to the epic housing boom and bust.

With the passage of over 20 years’ time, memories are fading fast as to how traumatic the tech crash was in real-time. Arguably, the boom phase started with the initial public offering (IPO) of Netscape in 1995. The spectacular success of the search-engine pioneer’s public debut began what would become, over the ensuing five years, the most intoxicating run of new issues in financial market history.

The seemingly insatiable appetite for IPOs from 1996 until early 2000 (with a brief hiatus caused by the 1998 Asian Crisis), set off an extraordinary sequence. As Wall Street was increasingly bestowing breathtakingly lofty valuations upon companies that were going public — in some cases, with little more than a business plan — tech entrepreneurs and venture capital (VC) investors were incentivized to an unprecedented degree to create and fund start-ups. This allure, combined with the legitimate breakthrough nature of the internet, proved an irresistible temptation for investors. And, of course, Wall Street underwriters, always in search of big fees, were only too happy to satisfy their cravings.

As more companies went public and saw their prices rise vertiginously, VC investors were emboldened like never before. Private placement memorandums (PPMs) and executive summaries, the essential documents of raising capital for start-ups, began circulating in Silicon Valley and Seattle, the dual hotbeds of tech innovation, like illicit drugs at a Hollywood party.

Unquestionably, most of these failed without making it to the going-public stage and the bulk of those would eventually flame out during the great tech bust. But enough made it to the NASDAQ to pour napalm on the speculative flames of entrepreneurs and investors alike. The term “internet millionaire” — and, often, billionaire — entered the popular lexicon. (Of course, none of this wildly speculative behavior could happen again, right? No way. What happened in 2020 and 2021 with IPOs, SPACs, cryptocurrencies, NFTs, and meme stocks must have been just the latest manifestations of the efficient market theory.)

Before long, the most intense stock market boom in 70 years, since the giddiest years of the Roaring 20s, was working its way to a feverish crescendo. While the majority of the companies that would become associated with the tech bubble, such as Netscape, Cisco, VMware, and EMC, hailed from California’s Bay Area, the most dominant of all, as it would turn out, came from the greater Seattle area. That dominant tech-bubble precursor and omnipresent distributor of goods would be none other than Amazon.

(Note: It’s not entirely on-topic, and it runs a little too long for inclusion here, but in the Appendix I’ve included a personal story on my humiliation as a result of the internet mania — and my own obtuseness. Let’s just say, but for one small act of omission, I could have been a billionaire. As they say, it’s only money; I just wish it didn’t have to be that much money!)

As the 1990s wound down, the tech sector wound up to a dizzyingly frenetic pace. While Netscape and Amazon were in the vanguard, scores of other internet companies followed close behind. Conditions had become feverish enough, as early as 1996, for then-Fed chairman Alan Greenspan to legendarily warn of “irrational exuberance” in the stock market.

As stock prices continued to rip higher over the next three years, the man known at the time as “The Maestro” for his deft handling of monetary policy and the economy, had his first major brush with fallibility. However, rather than maintaining the courage of his convictions and becoming increasingly vocal about the escalating mania, he began to equivocate.

Statements such as the following from his August 1999 speech in Jackson Hole, Wy., as the tech bubble was in full inflation mode, reflected his new-found ambivalence: “To anticipate a bubble about to burst requires the forecast of a plunge in the prices of assets previously set by the judgments of millions of investors, many of whom are highly knowledgeable about the prospects for the specific companies that make up our broad stock price indexes.” With those words, The Maestro made it clear he didn’t understand how the allure of overnight profits could distort the judgment of even professional – and allegedly knowledgeable – investors.

By the time the tech tide went out, institutional portfolios were bloated with internet and other “new economy” stocks. In fact, roughly half of the supposedly very diversified S&P 500 was in tech and telecom issues on the eve of the big meltdown, graphically illustrating that the “judgement of millions of investors” wasn’t so judicious.

Much more seriously, despite the growing obviousness that the behavior of the NASDAQ was becoming eerily similar to the market action leading up to the 1929 crash, Mr. Greenspan failed to do what prior Fed chairmen had done during earlier overheating markets. Individuals like William McChesney Martin, who coined the pitch-perfect adage that the Fed needed to remove the punch bowl just when the party was warming up, had proactively intervened to prevent past bull markets from morphing into bubbles by raising margin requirements. Yet, not once did the Greenspan Fed do so, even as the NASDAQ proceeded to nearly quadruple after The Maestro had warned of irrational exuberance.

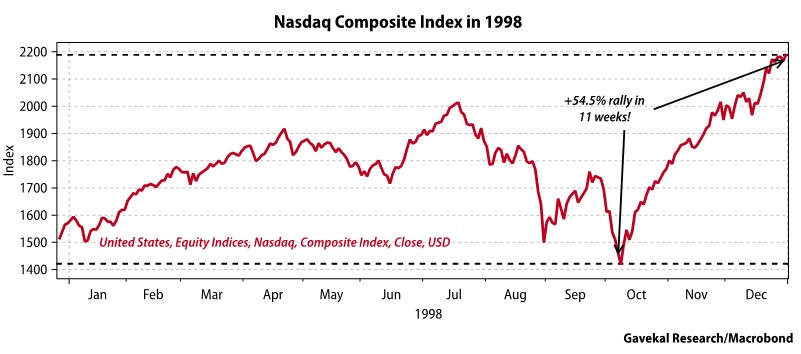

In fairness, Mr. Greenspan, like many (including this author), was concerned about the potential for severely negative repercussions due to the Y2K computer conversion looming. This, combined with the late ‘90s Asian crisis, which slammed markets globally, and triggered a particularly deep correction in many tech stocks, caused the Fed to actually cut rates in the fall of 1998. It also flooded the system with money during 1999 due to Y2K concerns, despite a booming US economy and a tech bubble that was distending to gargantuan proportions. By the end of 1998, the tremors of the late summer were long forgotten, with the NASDAQ roaring up almost 55% from the correction trough.

Figure 1

Figure 2

Yet, notwithstanding the Y2K issue, the Fed’s decision to relax monetary policy at a time of robust economic conditions and hyperventilating markets clearly injected rocket fuel into the financial system. Its actions during the Asian crisis also reinforced the belief by market participants that the Fed’s new unspoken third mandate[ii] (along with maintaining low inflation and high employment, two conflicting goals that were already challenging enough) was asymmetrical.

In English, this meant that investors now believed the Fed would step in during periods of market turbulence to support asset prices but would stand aside when they were rising, no matter how rapidly and excessively. Basically, with his 1999 Jackson Hole speech, Mr. Greenspan codified the Fed’s “see no bubble” policy. It was a mindset that would come back to haunt the Fed — and the global economy at large — fewer than 10 years later.

[i] Quantitative easing”, often referred to as QE, is the antiseptically technical term our central bank conjured up to obscure that it was, in fact, printing money. (For more details, please refer to the Glossary.) At least thus far, the major central banks have refrained from actually printing currency as Germany’s Weimar Republic infamously did in the 1920s; rather, they have created digital reserves out of nothing but their computers. Those reserves have then been transferred to the banking system, typically in return for government bonds.

[ii] Some would say the Fed of that era had three actual mandates, including maintaining moderate interest rates, though the latter was, and is, somewhat vague. Ironically, the deceased Lion of the Fed, Paul Volcker, felt two was one too many. The Fed of 2022 now also has to attempt to stop climate change and fight racial injustice. Why would anyone want to be its chairman these days?

Looking forward to reading this! Also curious if this will be a book or sent in chapters via email / Substack, which is great too.

David, thank you for an excellent commentary. I'm surprised that many people seem to be ignorant (or is it 'uninterested') in the lessons from history. Your writing joins the dots and helps us to see unfolding and repeating patterns. I've always believed that real 'wealth' is the production of goods and services which sell for a profit. 'Money' produced from a computer keyboard is not 'money', it is unreal - magic money with no collateral. That supposedly respectable economists can believe in the smoke and mirrors of MMT is beyond my ken. MMT defies financial gravity and leads me to question if we have open and free markets. Don't 'fundamentals' eventually win the day? Best wishes.